January 16, 2026

Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard business mileage rate and use an accountable plan, the reimbursement is tax-free. However, amounts paid over this rate, or under a non-accountable plan, become taxable income.

In this guide, we’ll explain when mileage reimbursement is taxable and when it’s not, how accountable plans work, and what records the IRS expects. You’ll also learn how small mistakes, like missing mileage logs or late submissions, can turn reimbursements into taxable wages, and how to avoid that with the right system in place.

Table of Contents

When Mileage Reimbursement Is Not Taxable

For mileage reimbursement to be non-taxable, it must meet specific IRS criteria. The main goal is to ensure that the money given to employees is truly a reimbursement for business expenses, not extra pay. Let’s break down the key points.

The Accountable Plan Rule

The IRS created what’s called an accountable plan. This is the golden rule for keeping mileage reimbursements tax-free. If your company’s reimbursement process fits this plan, neither you nor your employees will owe taxes on those payments.

Here’s what makes a plan accountable:

- Business Connection: The expense must be for a real business purpose. Think driving to a client meeting, not driving to work from home.

- Timely Substantiation: Employees need to prove their business expenses within a reasonable time, usually 60 days after the expense happened. This means providing mileage logs and other details.

- Return of Excess Reimbursements: If you pay an employee more than their actual business expenses, they must return the extra money within 120 days.

If any of these conditions are not met, your reimbursement plan becomes a nonaccountable plan, and all the mileage payments are taxed as regular wages.

This table highlights the differences:

| Aspect | Accountable Plan (Nontaxable) | Nonaccountable Plan (Taxable) |

|---|---|---|

| Business Purpose | Required for miles driven | Not verified; all income |

| Proof Provided | Mileage log + receipts within 60 days | No records, or submitted too late |

| Excess Funds | Employee must return any extra money | Employee keeps the money; fully taxable |

| Payroll Taxes | None | Yes, FICA/Medicare, and income tax |

When Mileage Reimbursement Is Taxable

There are situations where mileage reimbursement becomes taxable income. It’s important to know these so you can avoid unpleasant surprises for your employees and your business.

- Commuting Miles: Driving from home to your regular workplace is always personal travel. Even if you reimburse for it, that money is considered taxable income.

- Paying Over the IRS Rate: As mentioned, if you reimburse more than the current IRS rate, the amount above that rate is taxable. This excess is treated as wages.

- No Records or Poor Records: If your employees don’t provide proper mileage logs or their records are incomplete, the entire reimbursement amount becomes taxable because it doesn’t meet the accountable plan rules. The IRS cares about detailed and timely records.

- Nonaccountable Plan: If your reimbursement process doesn’t meet the three rules of an accountable plan, all reimbursements are taxable. They are added to an employee’s wages and subject to income tax and payroll taxes.

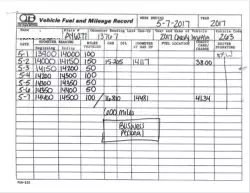

Essential Records for Nontaxable Reimbursements

Keeping good records is probably the most critical part of an accountable plan. Without them, even a correct reimbursement rate can lead to taxable income.

Employees need to provide:

- Date of the Trip: When did the trip happen?

- Destination: Where did they go?

- Purpose of the Trip: Why did they go there (e.g., client meeting, delivery, supplies)?

- Odometer Readings: The start and end readings of the year to show the exact miles driven.

A simple mileage log can capture all this. Many businesses find it tough to get employees to track their mileage perfectly. But consistent, accurate logs are your best defense against audits and ensure that mileage reimbursement remains tax-free.

MileageWise: Your Solution for IRS-Compliant Reimbursements

For small businesses, managing mileage reimbursement can feel like a headache. That’s where MileageWise comes in. We offer solutions designed to make tracking, logging, and reimbursing mileage easy and IRS-compliant. We understand that maximizing tax deductions and ensuring audit-proof mileage logs are key for you.

Try MileageWise for free for 14 days. No credit card required!

Wrapping It Up

Mileage reimbursement can be completely tax-free, but only if you follow the IRS rules closely. An accountable plan, tax-compliant mileage logs, and timely documentation make all the difference. When those pieces are missing, even well-intended reimbursements can turn into taxable income for employees and extra payroll taxes for your business.

The good news is that staying compliant doesn’t have to be complicated. With accurate records and a clear reimbursement process, you can protect your business, keep employees happy, and stay audit-ready. Tools like MileageWise help simplify mileage tracking and ensure your reimbursements stay IRS-compliant, so you can focus on running your business instead of worrying about tax mistakes.

FAQ

Is mileage reimbursement taxable income?

Mileage reimbursement is not taxable if it follows IRS rules. When employers use an accountable plan and reimburse at or below the IRS standard mileage rate, payments are tax-free. Reimbursements become taxable if they exceed the IRS rate or use a nonaccountable plan.

What makes a mileage reimbursement plan IRS-compliant?

An IRS-compliant mileage reimbursement plan requires a valid business purpose, timely mileage logs, and the return of excess payments. These three rules define an accountable plan and keep reimbursements non-taxable.

Are commuting miles taxable if reimbursed?

Yes. Commuting miles are always personal travel. Even if an employer reimburses them, the payment counts as taxable income under IRS rules.