Table of Contents

A road toll is a fee you pay to use certain roads, bridges, or tunnels. This fee helps pay for building and fixing those roads, and sometimes helps manage traffic.

What is a Road Toll and Why Do We Pay Them?

A road toll, also called a toll road fee, is basically a user fee for specific parts of our transportation network. Think of it like paying to use a special, well-maintained path. You have to pay this fee because the money collected is used to keep these roads in good shape, build new ones, or pay back money borrowed to build those roads. Using tolls is one way local and state governments get the cash needed for big road projects without relying only on taxes [Source 1].

Tolls are collected in different ways, especially now with modern technology. Most places in the United States use electronic systems.

How Toll Systems Work: Paying for Your Drive

Paying a toll used to mean stopping at a little booth and handing over cash. While some cash lanes still exist, technology has changed things a lot. Today, most toll roads use electronic ways to collect money, which makes things faster and helps reduce traffic backups [Source 2].

Electronic Toll Collection: This is the most common way to pay. You get a small device called a transponder (like E-ZPass or SunPass in the U.S.) for your car. You stick it on your windshield. As you drive through a toll area, the transponder talks to a sensor, and the fee is automatically taken from your prepaid account. It’s super simple, and you don’t even have to slow down much.

Open Road Tolling (ORT): This is even faster! With ORT, you don’t stop or even slow down for a toll plaza. You just keep driving at highway speed [Source 3]. The system either reads your transponder or, if you don’t have one, takes a picture of your license plate. Then, they send a bill in the mail to the car’s owner. This is often called “Pay by Plate” or “Toll by Plate.”

Cash Payment: While less common now, some toll roads still have lanes where you can pay with cash. However, many new or updated toll roads are going all-electronic, meaning no cash is accepted [Source 3].

Variable Pricing: Some busy toll roads charge different amounts depending on the time of day. During rush hour, the toll might be higher to make you think twice about driving then. This helps spread out traffic and makes travel smoother for those who need to drive at the busiest times [Source 5]. It’s a way to manage congestion.

FAQ

What is a toll road?

A toll road is a public or private roadway on which drivers must pay a fee (toll) for passage, typically collected at toll booths or electronically via transponders.

Are toll expenses deductible?

Tolls paid while driving for business, charitable purposes, or in some cases, moving or medical reasons are deductible expenses—keep receipts or electronic records and include them alongside your mileage logs. They can be claimed as itemized deductions

Can MileageWise help track toll expenses?

Yes, MileageWise lets you log toll costs with each trip entry, ensuring all tolls are documented and included in your IRS-compliant expense reports.

Try MileageWise for free for 14 days. No credit card required!

Related Terms

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

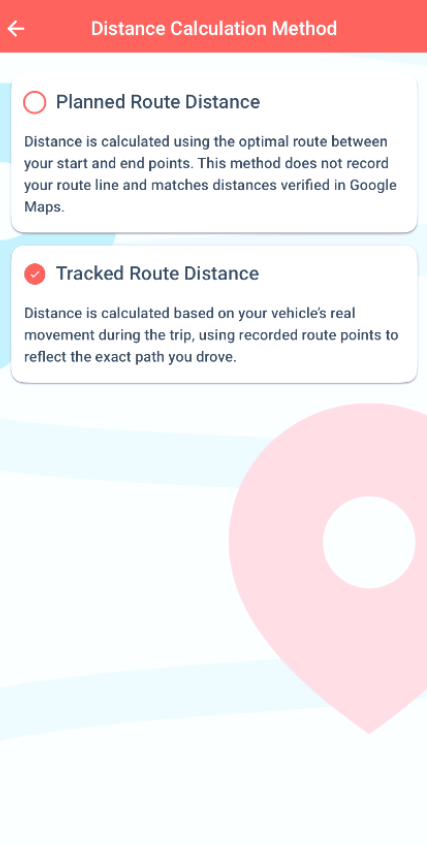

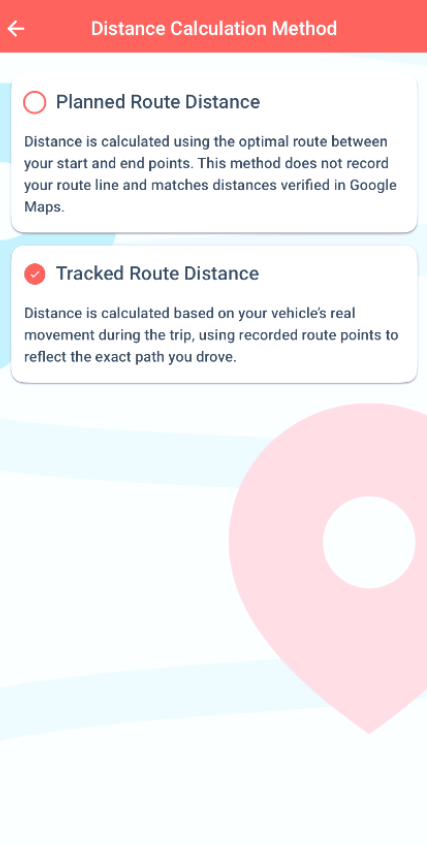

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Related Guides

Related Blogposts

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last Updated: October 29, 2025 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It