Table of Contents

Commuting is how you travel to and from your job. It’s a big part of your day, and it affects your wallet, your health, and your job choices.

How Long Do People Commute in the U.S.?

Let’s look at the numbers on commuting in the United States. Most people spend time traveling to work each day.

As of 2024, the usual commuting time is about 25.6 minutes one way. Before the pandemic, in 2019, it was a bit longer, around 27.6 minutes. So, things are a little faster now for some.

Many Americans have a commute that’s not too long. Over half of workers travel between 10 and 29 minutes each way.

Most people still go to work every day. About 76% of American workers commute daily. But, more people are working from home now. Over 15% work remotely after 2020. Before that, only about 5% did. This shift changes commuting for many.

Long commutes, over an hour each way, are happening less often. In 2021, about 7.7% of workers had these long trips. In 2019, it was nearly 10%.

The government keeps track of commuting numbers. The Bureau of Transportation Statistics looks at travel times, how safe the trips are, and how much it all costs.

How Do People Get to Work?

People use different ways to commute:

- They drive their own car.

- They ride public buses or trains.

- They bike.

- They walk.

- They share rides with others.

- They work from their home.

Driving alone is still the most common way to commute.

Is Commuting Considered Business Mileage?

No, commuting is not considered business mileage.

Business mileage refers to trips taken specifically for work-related purposes—not including your daily commute between home and your regular workplace.

For example, the following do count as business mileage:

- Driving to a client meeting

- Picking up supplies for your business

- Traveling to a house on sale as a realtor

- Visiting another office or work location during your workday

But the drive from home to your first work activity and the drive home from your last work activity—even if it’s not your main office—is still considered commuting and does not qualify as business travel.

Can You Claim Commuting Miles as a Business Expense?

Generally, no.

The IRS does not allow you to deduct commuting expenses between your home and your regular workplace. But there are a few exceptions where commuting-like travel can actually qualify as business mileage:

✅ Exceptions Where Travel Might Count as Business Mileage:

- Your home is your main workplace: If you work from home and travel to other locations for business, those trips are deductible.

- Travel between job sites: If you work at multiple locations in one day, driving from one site to another can be counted as business mileage (just not the trip to or from home).

- Temporary distant worksite: If you’re sent to a temporary job location outside your usual metropolitan area, that travel can qualify as business mileage.

Even if commuting miles aren’t deductible, if your employer reimburses you for business trips, it’s still smart to track both personal and business mileage. That way, you’ll stay compliant with IRS rules and ensure accurate reporting.

FAQ

What counts as commuting mileage?

Commuting mileage includes the distance traveled between your home and your regular workplace, which is typically not deductible for tax purposes.

Can commuting mileage ever be deductible?

Generally, commuting isn’t deductible. However, certain situations, such as temporary work locations or home offices as primary workplaces, might qualify for mileage deductions.

Does MileageWise track commuting miles separately?

Yes, MileageWise allows you to categorize commuting miles distinctly from business trips, helping maintain clear and accurate records.

Try MileageWise for free for 14 days. No credit card required!

Related Terms

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

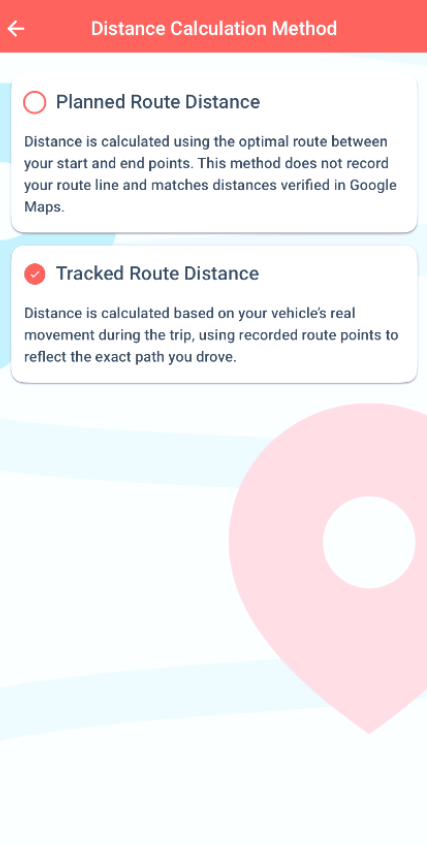

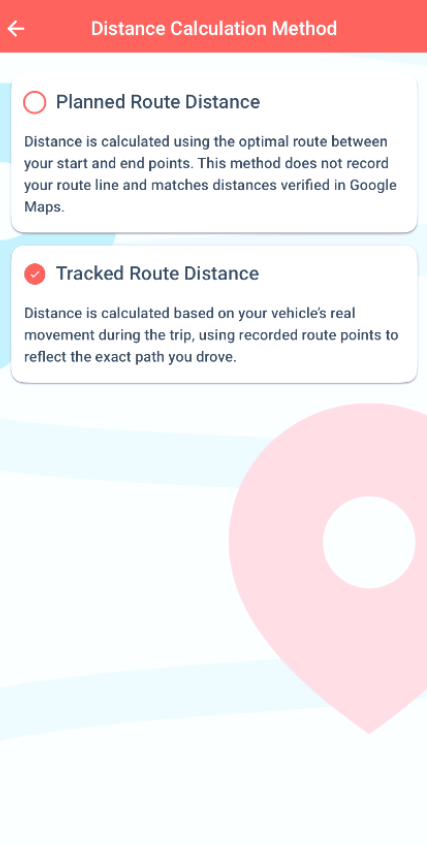

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Related Guides

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last Updated: October 29, 2025 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It