Last updated: May 13, 2025

An Odometer Reading Calculator is your secret weapon for smart vehicle ownership and maximizing every possible tax deduction. If you use your vehicle for work, tracking your mileage accurately is non-negotiable for getting the most out of your tax return. This article will guide you through what an odometer reading calculator does and, more importantly, how precise mileage tracking is the key to unlocking significant tax savings, powered by smart tools designed for busy professionals like you.

Table of Contents

What is an Odometer Reading Calculator and Why Does it Matter?

Think of an odometer reading calculator as a helpful tool that helps you figure out your vehicle’s mileage at specific times or between trips. It’s tied to your vehicle’s odometer, which is the device that measures every mile your car travels. Understanding these numbers isn’t just for knowing how much you drive; it’s crucial for managing costs, taking care of your car, and hitting those important mileage tax deductions.

Why Your Odometer Reading is a Big Deal

Your odometer reading plays a huge role in how you manage your vehicle and your finances. Here’s why:

- Tax Deductions: For anyone using their car for business, the IRS allows you to deduct a certain amount per mile driven for qualified business purposes. The accuracy of your odometer reading directly impacts the amount you can claim. As the IRS states, you can use the standard mileage rate. This can save you a significant amount on your taxes. In addition, the start and end-of-year odometer readings must be present on your mileage log.

- Vehicle Value: The mileage on your vehicle’s odometer heavily influences its resale value. Higher mileage generally means more wear and tear, which can lower the car’s worth.

- Maintenance Planning: Knowing your mileage helps you stick to regular maintenance schedules, which keeps your car running smoothly and prevents expensive breakdowns.

- Lease Management: If you lease your vehicle, you have mileage limits. Your odometer reading can help you stay within those limits and avoid costly penalties at the end of your lease.

Below is a quick look at a mechanical and a digital odometer. Watch this odometer reading guide to learn more.

How an Odometer Reading Calculator Works (and Its Limits)

A basic odometer reading calculator often helps you estimate mileage based on a known previous reading and the current date, often assuming a consistent daily average. For instance, if you know your car had 10,000 miles on January 1st and it’s now July 1st, and you drive about 50 miles per day, the calculator can provide an estimate of your past readings.

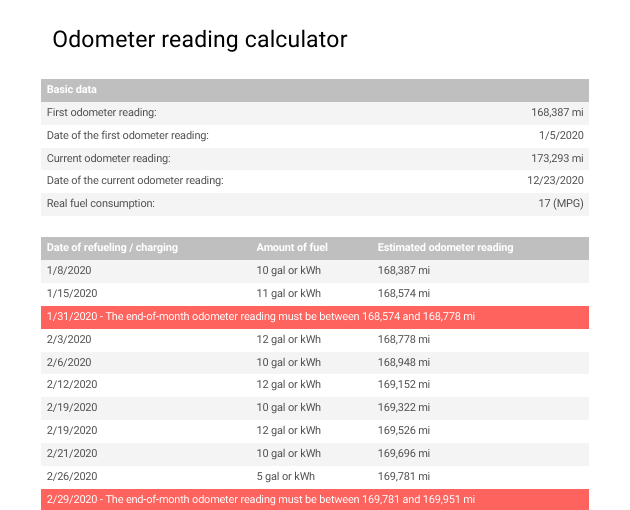

Your fuel consumption is also a smart indicator of your past odometer readings. If you’ve kept your refueling receipts, you’re in luck: You can trace back your refuelings and estimate how many miles you traveled between gas station visits or recharges. Here is an example for this method:

However, these basic tools have limitations. Real-world driving isn’t always consistent. Business trips, vacations, or periods of less driving can throw off simple calculations. While basic calculators offer a starting point, they don’t provide the detailed, trip-by-trip accuracy needed for IRS-compliant mileage logs.

For truly accurate and audit-proof mileage logs, you need more than just a simple odometer reading calculator. You need a system that automatically tracks your trips in detail.

Beyond the Odometer: Why Accurate Mileage Tracking is Key

While knowing your overall odometer reading is a start, for tax purposes, the IRS requires a detailed log of your business mileage. This means recording every trip you take for work, including the date, destination, purpose, starting odometer reading, and ending odometer reading for that specific trip.

Why is this distinction so important? Because you can only deduct mileage driven for qualified business activities. Your personal driving, commuting, and other non-business trips aren’t deductible. An odometer reading calculator might help you estimate overall mileage, but it won’t automatically separate your business trips from your personal ones.

Manually logging mileage can be a real headache and prone to mistakes. Studies have shown that relying on simple spreadsheets can lead to missed deductions and potential issues if audited. That’s where a good odometer reading calculator or, better yet, a comprehensive mileage tracking system comes in. Accurate, detailed trip logs are the cornerstone of maximizing your mileage deductions and ensuring you’re fully prepared if the IRS ever asks for proof.

MileageWise: Accurate Odometer Readings and Mileage Logs

Navigating the world of mileage tracking for tax deductions can feel complex. That’s why MileageWise created comprehensive solutions designed to make it easy, accurate, and completely IRS-compliant. We take the guesswork out of recording odometer readings for your trips and ensure you claim every single mile you’re entitled to deduct.

MileageWise understands that manual logging is time-consuming and often inaccurate. Our tools automate the process and provide powerful features to handle even the trickiest mileage tracking scenarios.

How MileageWise Goes Beyond the Basic Odometer Reading Calculator

Sometimes you forget to track a trip, or you need to recreate past logs. Perhaps you need to calculate your starting odometer reading of the year, which is necessary for your log.

This is where MileageWise truly shines, offering features unique to our platform:

- Google Maps Timeline Integration: Exclusively with MileageWise, you can import your Google Location History directly into our platform. This is a game-changer for recapturing past trips. You can easily review your history, identify business trips, and integrate that data into your log.

- AI Wizard Mileage Log Generator: This exclusive tool is like having an expert accountant by your side. The AI Wizard reconstructs your past trips, fills in missing data points, and generates a comprehensive mileage log that is guaranteed to be IRS-compliant. It uses your imported data, known locations, and driving habits to accurately recreate your travel history.

- Comprehensive Trip Management: The Dashboard provides a user-friendly interface to review, edit, categorize, and manage all your trips. You can easily distinguish between business and personal mileage.

- Odometer Reading Calculator: In addition to generating your mileage log, the system can automatically calculate your odometer reading at any point, whether it’s a monthly check-in or after a specific trip.

Additional MileageWise Advantages

MileageWise stands out with features designed for long-term value and peace of mind:

- Lifetime Plans: We were the first in the industry to offer lifetime plans, providing significant long-term savings compared to subscription-based services. Pay once and track your mileage forever.

- Comprehensive Support: Our dedicated customer service team is ready to assist you. We also offer a wealth of resources to help you master mileage tracking and ensure IRS compliance.

By using MileageWise, you’re not just getting an odometer reading calculator; you’re getting a complete system that captures accurate mileage data, builds audit-proof logs, and helps you maximize your tax deductions with confidence.

Try MileageWise for free for 14 days. No credit card required!

My Journey to Stress-Free Deductions: A Customer Story

I used to dread tax season. As a freelance consultant, my car is essential, but tracking mileage felt like a second job. I’d jot down rough odometer readings or guess based on routes, always worried I was missing out on deductions. The thought of an IRS audit made it worse. How could I justify my scribbled notes and estimates?

Then I found MileageWise. I was skeptical, thinking it’d be just another complicated app. But their Google Maps Timeline integration was a game-changer. I imported my driving history, and the AI Wizard recreated my mileage log, complete with accurate trip data. It even worked as an odometer reading calculator, estimating past readings based on my routes.

The best part? The log was IRS-compliant and ready for review, thanks to their Built-in IRS Auditor. My accountant was impressed. I claimed more business mileage than ever, miles I’d have missed on my own. Tax time is no longer stressful, and I feel fully prepared and confident.

Time to Take Action: Secure Your Tax Deductions Today

Don’t leave your hard-earned money on the table because of inaccurate mileage tracking. An Odometer Reading Calculator can be a starting point, but for maximum tax savings and audit protection, you need a dedicated solution.

Here’s how to get started:

- Understand the IRS Requirements: Know what documentation you need for business mileage deductions.

- Stop Relying Solely on Best Guesses: Simple odometer reading calculations won’t cut it for IRS compliance.

- Learn About Rekindling Past Mileage: If you’ve missed tracking, look for tools like MileageWise’s AI Wizard and Google Maps Timeline integration.

- Prioritize IRS Compliance: Choose a solution designed to generate audit-proof reports.

- Start Tracking Consistently: The sooner you start using a reliable system, the easier tax time will be.

FAQ

What is an odometer reading calculator?

An odometer reading calculator is an online tool used to compute the distance traveled by a vehicle. By entering the starting and ending odometer readings (in miles or kilometers), the calculator determines the total distance covered during a trip or over a certain period.

It can also refer to a tool that calculates the odometer readings between trips.

How do I use an odometer reading calculator?

Simply input two of the following: starting odometer reading, ending odometer reading, or distance traveled. The calculator will compute the third value automatically. For instance, entering a start of 15,000 miles and a distance of 300 miles will give an ending reading of 15,300.

Why should I calculate odometer readings?

Calculating odometer readings helps with:

– Tracking miles for business travel and tax deductions (e.g., for IRS mileage logs in the U.S.).

– Planning vehicle maintenance by knowing mileage intervals.

– Monitoring vehicle usage for fleet management or personal budgeting.

Can I use an odometer calculator for IRS mileage logs?

Yes. Odometer calculators help you keep accurate records of miles traveled, which the IRS requires when claiming business mileage deductions. However, for a valid log, you must also note trip purpose, dates, and destinations.

What should I do if I forgot to record my starting or ending odometer reading?

If you missed recording a reading, you can estimate the distance using:

– Known trip distance (from maps or route planners).

– Previous maintenance or fuel logs.

Some advanced calculators or mileage log apps allow reconstruction based on trip mapping.

How often should I record my odometer readings?

– For maintenance: At each oil change or service.

– For tax records: If you log manually, you should write down the beginning and end odometer readings of each business trip, but only the start and end of the year odometer reading needs to be present in your log.

– For fleet management: Regularly (e.g., weekly or monthly, or every fill-up).

Are there calculators that work with kilometers as well as miles?

Yes. Most reputable online odometer calculators allow you to select either miles or kilometers as the unit of measurement and will calculate the distance accordingly.

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |