Home » Mileage Tax Deduction » Historical Mileage Rates

Last Updated: January 5, 2026

The IRS mileage rate history helps you figure out what you can deduct for driving a car for business, medical, moving, or charity work. These rates are a big deal for freelancers, contractors, and anyone who uses their own car for work. This guide gives you a clear overview, with facts, historical data, and real-world examples.

Table of Contents

What is the IRS Mileage Rate?

The IRS sets standard mileage rates each year. You can deduct these rates for every deductible mile to reduce your tax liability. They aim to reflect the true cost of running a vehicle, covering vehicle costs like gas, maintenance, tires, insurance, and car depreciation.

Current Mileage Rates

For 2026, the mileage rates are the following:

- Business mileage rate: 72.5 cents per mile. Every mile for business counts, except for commuting.

- Medical or Military Moving mileage rate: 20.5 cents per mile. Covers medical mileage under certain conditions and moving for active duty military members.

- Charity mileage rate: 14 cents per mile. This rate stays the same because it’s set by Congress, not the IRS.

This video is a good resource to understand deductible vs. non-deductible mileage.

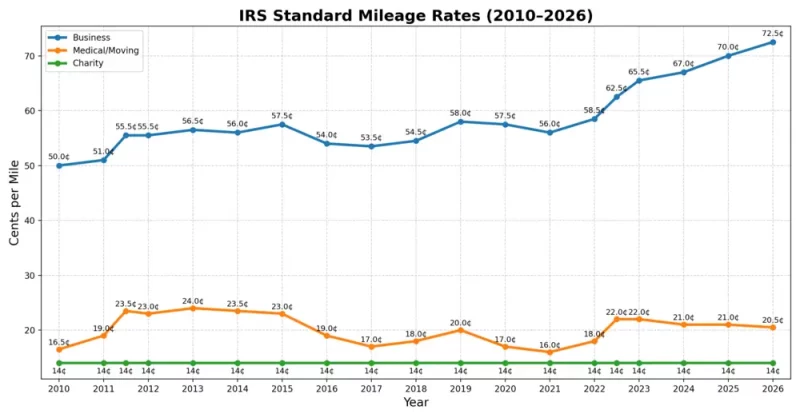

Historical IRS Mileage Rates

This chart shows how the mileage rates have changed over the years. They usually change each year to match changing costs, especially the business mileage rate. The charitable mileage rate is an exception because it is tied to federal law.

While this chart serves as a visual overview, the table below lists past mileage rates in detail — perfect if you want to find the exact figure for a specific year or period.

| Year | Business Mileage Rate | Medical/Moving Mileage Rate | Charity Mileage Rate |

|---|---|---|---|

| 2026 | 72.5¢ | 20.5¢ | 14¢ |

| 2025 | 70¢ | 21¢ | 14¢ |

| 2024 | 67¢ | 21¢ | 14¢ |

| 2023 | 65.5¢ | 22¢ | 14¢ |

| 2022 |

Jan–Jun: 58.5¢

Jul–Dec: 62.5¢

|

Jan–Jun: 18¢

Jul–Dec: 22¢

|

14¢ |

| 2021 | 56¢ | 16¢ | 14¢ |

| 2020 | 57.5¢ | 17¢ | 14¢ |

| 2019 | 58¢ | 20¢ | 14¢ |

| 2018 | 54.5¢ | 18¢ | 14¢ |

| 2017 | 53.5¢ | 17¢ | 14¢ |

| 2016 | 54¢ | 19¢ | 14¢ |

| 2015 | 57.5¢ | 23¢ | 14¢ |

| 2014 | 56¢ | 23.5¢ | 14¢ |

| 2013 | 56.5¢ | 24¢ | 14¢ |

| 2012 | 55.5¢ | 23¢ | 14¢ |

| 2011 |

Jan–Jun: 51¢

Jul–Dec: 55.5¢

|

Jan–Jun: 19¢

Jul–Dec: 23.5¢

|

14¢ |

| 2010 | 50¢ | 16.5¢ | 14¢ |

Recent Mileage Rate Trends 2020-2026

As you can see above, the past few years have brought notable shifts in IRS mileage rates. These changes largely reflect fuel prices, inflation, and the way driving patterns changed during and after the pandemic. In 2020 and 2021, rates dipped slightly as COVID-19 lockdowns reduced travel and fuel demand. Starting in 2022, the business rate rose sharply, mirroring higher gas prices and increasing vehicle maintenance costs. Since then, the business mileage rate has increased each year.

The medical and moving rate has declined slightly since 2022, while the charity rate has remained fixed at 14¢.

How Historical Mileage Rates Affect Your Tax Deductions

You might wonder why past IRS mileage rates should matter to you. The truth is, you can claim mileage deductions retroactively for up to three years, which means using the correct historical rate can help you recover significant tax savings from previous returns. However, those same three years are also open to IRS audits, so accuracy is key. Applying the proper rate for each year ensures your retroactive mileage deductions are compliant.

Recreating Past Mileage Logs with MileageWise

Maybe you’ve just discovered that you can still claim mileage deductions for the past three years, but you don’t have complete records to prove your business miles. Or perhaps you’ve already claimed mileage in those years, yet some of your documentation is missing and you’re now facing an IRS audit or simply want to make sure everything checks out.

In either case, that’s where MileageWise comes in. We offer solutions built for exactly these situations:

Google Maps Timeline Import

MileageWise can read your past movements from Google Maps Timeline and convert them into a detailed, IRS-compliant mileage log, so you can save time and claim every eligible deduction.

AI Mileage Log Generator

If your Google Timeline is missing, this smart tool can automatically recreate your past trips and fill in any missing details, even from fragmented data. Set your parameters and preferences for a complete and compliant result.

IRS Compliance Auditor

Don’t spend hours analyzing your log, searching for mistakes and second-guessing! Our built-in auditor ensures everything is consistent and meets IRS rules.

Comprehensive Trip Management

If you have regular clients or fixed routes, you can upload them easily from a spreadsheet. You can then set up recurring trips or edit them in bulk.

Unique to MileageWise

Lifetime Plans: Pay Once, Stay IRS-Ready Forever

Forget subscriptions. MileageWise is the only mileage tracker that lets you pay once and track for life — with all the tools you need to stay audit-proof.

- Small Lifetime Plan: Enjoy unlimited mileage tracking, easy log creation, and essential smart features — all for a one-time payment of $119.

- Gold Lifetime Plan: Get full access to every feature, including past trip reconstruction, Google Timeline import, and detailed IRS-compliant reports. Ideal for rebuilding old logs or preparing for an audit.

Customer Support That Understands Drivers

Whether you’re just getting started or organizing reports for tax season, our team knows the ins and outs of mileage tracking. You’ll get quick, practical help — no long waits or generic replies.

Try MileageWise for free for 14 days. No credit card required!

AI Logs & Google Timeline Import

Customer Success: From Audit Panic to Relief

I’m a real estate agent, always on the road showing properties and meeting clients. For years, I barely tracked my business miles — a few notes here and there. Then came the nightmare: an IRS audit. They asked for my mileage logs, and I had next to nothing. I felt sick thinking about losing all those deductions and possibly paying penalties for sloppy records.

That’s when I found MileageWise. Using my Google Maps Timeline, it instantly pulled up my past trips and turned them into a clear, IRS-compliant mileage log. No guesswork, no missing drives, just accurate records ready for review. When I submitted it, the auditor accepted everything without question. What started as a terrifying audit turned into a huge relief. And I even claimed miles I didn’t realize I’d missed.

Final Takeaways

Understanding historical IRS mileage rates is crucial for anyone looking to secure and maximize their tax deductions. Keeping accurate records is not just a good idea; it’s essential for avoiding issues with the IRS.

FAQ

How do I apply historical mileage rates to deductions?

Use the mileage rate that was in effect when the miles were driven. If a year had a midyear change (e.g., 2022), split your mileage by the applicable date ranges and apply each rate to the miles driven in that period.

Can I switch between the standard mileage rate and the actual expense method?

You choose one method per vehicle per year. To use the standard mileage rate for a car, you must elect it in the first year the vehicle is placed in service for business.

If you ever claimed Section 179, bonus (special) depreciation, or MACRS accelerated depreciation on that vehicle under the actual method, you generally cannot switch back to the standard mileage rate for that vehicle. For leased vehicles, if you choose the standard mileage rate, you must use it for the entire lease term (including renewals).

What counts as business miles vs. commuting miles?

Business miles: Travel between workplaces, to meet clients, to temporary job sites, and other ordinary and necessary business travel. Commuting miles: Travel between your home and your regular, main workplace—these are not deductible. If you have a qualified home office as your principal place of business, trips from home to other work locations can be business miles.

What records should I keep for mileage deductions?

Maintain a detailed mileage log with date, destination, purpose, and trip distance. You can still deduct parking and tolls separately when using the standard mileage rate.