Mileage Reimbursement Guide

Home » Mileage Reimbursement Basics » Mileage Reimbursement Policy Template

Last Updated: January 12, 2026

A mileage reimbursement policy template is a formal document that helps businesses fairly pay back employees for using their personal cars for work travel. It spells out essential details like eligible expenses, the payment rates, how to track mileage, and how to submit claims. Getting this right is key for businesses of all sizes, ensuring everyone is on the same page and avoiding tricky tax situations. This guide covers everything you need to know about setting up your own policy.

Table of Contents

What a Mileage Reimbursement Policy Template Includes

Having a clear policy saves everyone a lot of headaches. It makes sure your employees get paid on time and helps your business stay compliant with tax rules.

Let’s look at the main parts of a good mileage reimbursement policy.

Purpose and Scope

First things first, your policy needs a clear goal. It should state that the policy aims to fairly pay employees back for their authorized business travel. This means things like visiting clients or attending training, not just their daily drive to and from work. It applies to those employees who use their own cars for company business.

Who Qualifies and What Trips Count

Not all mileage is created equal. Your policy should clearly define who can get reimbursed. Typically, this includes employees who need to travel for work purposes.

Here’s a quick look at what usually qualifies:

- Work-related travel from one worksite to another.

- Client meetings and sales visits.

- Training sessions or conferences away from the main office.

- Temporary assignments or job sites.

What doesn’t count? Usually, your daily drive from home to the office. Personalized errands or detours are also typically not covered. If an employee drives from home directly to a client, they’d usually subtract their normal commute distance.

The Reimbursement Rate and How to Calculate It

The reimbursement rate is how much you’ll pay per mile. Most U.S. businesses use the IRS standard mileage rate. This rate covers typical car costs like gas, oil, maintenance, tires, insurance, and wear and tear.

It’s common for businesses to stick to the IRS rate because reimbursements at or below this rate, with proper documentation, are usually not taxed as income for the employee. If you pay more than the IRS rate, the extra amount might be taxable. Also, parking fees and tolls are usually reimbursed separately, on top of the mileage.

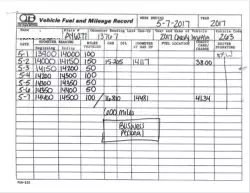

How to Track and Document Mileage

Accurate tracking is super important for both your business and your employees. It confirms the travel happened and helps you stay IRS-compliant. Employees should keep a detailed mileage log or keep all business-related receipts, depending on the reimbursement method.

Employees may receive reimbursement templates in Excel or Google Sheets, but some companies use dedicated expense or mileage tracker apps for this.

The Submission Process

Once mileage is tracked, employees need a clear way to submit their claims. This often involves:

- Filling out a specific form, either a PDF or an Excel spreadsheet.

- Attaching any necessary receipts for tolls or parking.

- Getting supervisor approval.

- Submitting the form by a certain deadline, often monthly.

After submission, the reimbursement is usually added to the employee’s payroll or processed through a separate system.

Tax Rules and Payment Timelines

When documented correctly and paid at or below the IRS rate, mileage reimbursements are tax-free for employees. This falls under what the IRS calls an “accountable plan.” If documentation is poor or the rate is too high, the reimbursement could be counted as taxable income.

In some states, like California, businesses are legally required to reimburse employees for business expenses, including mileage. So, always check your state’s laws.

How MileageWise Helps with Reimbursement Policies

Once you have your mileage reimbursement policy template in place, the next step is making it easy to follow. That’s where MileageWise comes in handy, especially for small business owners and teams.

MileageWise helps companies and teams manage mileage reimbursement by combining accurate mileage tracking with vehicle expense tracking in one app. And through a centralized dashboard, businesses can

- review trips, expenses, and reimbursement data in one place

- apply company reimbursement policies consistently

- import spreadsheets and Google Timeline drives

- generate IRS-compliant mileage logs.

This makes reimbursement easier to manage, improves visibility across teams and vehicles, and reduces administrative effort while helping companies stay compliant.

Try MileageWise for free for 14 days. No credit card required!

Conclusion

A mileage reimbursement policy template helps your business stay fair, organized, and compliant. It sets clear rules for employees and protects your company from tax issues or misunderstandings. Once the policy is in place, the right tools make all the difference. Using a solution like MileageWise simplifies tracking, reporting, and reimbursement, so mileage stays accurate, employees get paid correctly, and your business stays audit-ready with less effort.

FAQ

What is a mileage reimbursement policy template?

A mileage reimbursement policy sample or template is a written document that outlines how a company reimburses employees for business-related driving. It usually explains what counts as business mileage, which reimbursement method is used, the applicable mileage rate, documentation requirements, and how employees should submit mileage reports.

Do companies have to use the IRS mileage rate in their policy?

No, companies are not required to use the IRS standard mileage rate. Many businesses choose it because it is simple and widely accepted, but employers can also use a custom per-mile rate, a car allowance, or other reimbursement methods. However, using the IRS rate can make tax treatment and compliance easier.

How often should we update the policy and template?

Review at least annually and whenever the IRS rate or relevant state laws change. Update the rate, submission rules, and approval steps as needed.