Mileage Reimbursement Guide

Home » Mileage Reimbursement Basics » Mileage Reimbursement Policy

January 9, 2026

A mileage reimbursement policy is a set of rules your company uses to pay employees when they drive their personal cars for work. This guide helps small business owners and HR leaders understand how to create a fair, compliant, and easy-to-manage policy, ensuring everyone gets what they deserve. It covers everything from what trips count to the latest IRS rates and how to handle taxes.

Table of Contents

What is a Mileage Reimbursement Policy and Why Do You Need One?

A mileage reimbursement policy is your company’s blueprint for compensating employees who use their personal vehicles (cars, vans, pick up trucks) for business travel. Instead of paying for gas, insurance, and repairs separately, most U.S. employers use a cents-per-mile rate. This system helps keep things fair and simple.

Having a clear policy is not just about being nice to your employees; it is crucial for your business’s legal and financial health. A well-defined policy helps you:

- Avoid legal risks: Some states require you to pay back business expenses, including mileage. If you do not, you could face lawsuits or audits.

- Keep employees happy: When employees feel fairly compensated for their work related driving, they are more engaged and less likely to look for work elsewhere.

- Save on taxes: Proper mileage reimbursement can be tax free for employees and a deductible expense for your business, if you follow IRS rules.

- Control costs: A clear policy with good tracking prevents overspending and ensures consistency.

In short, a strong mileage reimbursement policy protects your business, keeps your team satisfied, and saves you money.

Who is eligible for mileage reimbursement?

Generally, mileage reimbursement applies to W 2 employees who use their personal vehicles for company business. This can include:

- Field staff visiting clients or job sites.

- Sales representatives traveling to meetings.

- Managers driving between different company branches.

It is important to clearly define these roles in your policy. Independent contractors, for example, typically factor their driving costs into their fees, so they generally do not receive separate company mileage reimbursement.

What kind of trips qualify (and what doesn’t)?

Not all driving counts as business mileage. Your policy needs to draw clear lines.

Qualified business mileage typically includes:

- Driving to client meetings or job sites.

- Traveling between different work locations for the same employer.

- Trips to pick up supplies or equipment for the business.

Most personal use and commuting miles (driving from home to your regular office) are not reimbursable. For example, if an employee works from home, their first trip to a client might count as business mileage if their home is considered their primary work location. However, if they just stop at the office before going to a client, the home to office part of the trip is usually not reimbursed.

How much should you reimburse per mile?

Choosing the right reimbursement rate is central to your policy. Most businesses use the IRS standard mileage rate or a similar benchmark.

The IRS sets this rate annually to cover the actual costs of owning and operating a vehicle, including depreciation, insurance, maintenance, and fuel. It applies to gas, diesel, hybrid, and electric vehicles.

Why do many employers choose the IRS rate?

- Tax free for employees: When reimbursed at or below the IRS rate under an “accountable plan,” the money employees receive is generally not considered taxable income.

- Reasonable and fair: The IRS rate is based on a yearly study of vehicle costs, so it is a good benchmark for what drivers actually spend.

- Simplicity: It is easy to apply and understand.

Some employers might choose to pay below the IRS rate to save money. If you do this, understand that the IRS rate is a cap for tax free reimbursement, not a legal minimum. However, remember that some states, like California, Illinois, and Massachusetts, require employers to reimburse all necessary business expenses, including mileage. In these states, paying too low a rate could still cause you legal problems.

Common Mileage Reimbursement Methods

When setting up your mileage reimbursement policy, you will usually pick one of these four approaches, or even combine them.

| Method | How it works | Best for |

|---|---|---|

| IRS Cents-Per-Mile (CPM) | You pay a set rate, such as the annual IRS mileage rate, for each documented business mile driven by the employee. | Simple programs and employees who drive a mixed number of miles. |

| Fixed and Variable Rate (FAVR) | Your company pays a fixed monthly amount for costs like insurance and depreciation, plus a variable per-mile rate for fuel and maintenance. This method is typically recommended by specialized providers. | Employees who drive a lot and teams spread across different locations. |

| Car Allowance (Flat Allowance) | You provide a fixed monthly payment, such as $400–$700, regardless of miles driven. This usually counts as taxable income. | Easy administration, more common in older reimbursement programs. |

| Company Vehicles / Fleet | Your business owns or leases vehicles and covers all operating costs, so no mileage reimbursement is required. | Roles that require heavy driving or specialized vehicles. |

Crafting Your Company’s Ideal Mileage Reimbursement Policy

To create a powerful mileage reimbursement policy, you need to cover several key areas. These points make your policy fair, understandable, and legally sound.

1. Define Eligibility and What Counts

Start by drawing clear boundaries. Your policy should spell out:

- Who is eligible: List job titles or departments, such as “all full time field sales representatives” or “managers traveling between company offices.”

- What business mileage means: Give examples like “travel to client sites” or “trips to pick up company supplies.”

- What does not count: Explicitly state that “commuting from home to your regular primary work location” and “personal travel” are not reimbursed. This helps avoid confusion. As a simple rule, the IRS regards commuting as a personal expense.

2. State Your Reimbursement Rate

Clearly explain the rate your company uses.

- Will you use the IRS standard business mileage rate or a custom rate?

- Explain that your company will review and update this rate annually following IRS announcements.

- If you use a different rate, explain your rationale. Be aware that paying significantly below the IRS rate in states like California could create problems.

Remember, the IRS rate is built to cover a lot. It includes gas, maintenance, insurance, and the wear and tear on the car. Parking fees and tolls are usually reimbursed separately, so make sure your policy clarifies this.

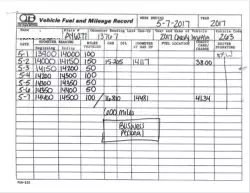

3. Documentation: How to Track and Submit

This is where many policies fall short. Good documentation is key to IRS compliance and preventing fraud.

- Require detailed logs: Employees must record the date, start and end locations, business purpose, and the number of miles driven for each trip.

- Acceptable tracking methods: Mention options like paper logs, spreadsheets, or mileage tracking apps. Encourage or require apps, as they boost accuracy and make tracking easier for everyone.

- Submission process: Set clear deadlines (e.g., “monthly, by the 5th business day”) and outline how employees should submit their logs (e.g., “via the company’s expense reporting system”).

Without proper documentation, reimbursements could become taxable for employees, and your business might not be able to deduct the expenses.

4. Tax and Legal Compliance

Your policy needs to reflect the tax rules.

- Accountable Plan: Explain that your company’s policy is designed as an “accountable plan” under IRS rules. This means reimbursements are generally not taxable income for employees because they:

- Have a business connection.

- Are properly accounted for (documented).

- Any excess reimbursements are returned within a reasonable time.

- State laws: Highlight that while there is no federal law requiring mileage reimbursement for all employees, many states do. If you have employees in states like California, Illinois, or Massachusetts, your policy must meet those state requirements.

For up to date information about mileage rates and other vital tax details, you can always check out the IRS official website: Standard mileage rates | Internal Revenue Service.

5. Review and Updates

Car costs change. IRS rates change too. Your policy should have a plan for staying current.

- Annual review: Commit to checking IRS mileage rate announcements every year and updating your policy as needed.

- Right to audit: Include a clause stating that the company can audit mileage logs to ensure accuracy and compliance. This helps deter misuse.

This video might help you decide on which method fits your company most.

MileageWise: Your Solution for IRS-Proof Mileage Reimbursement

Managing a mileage reimbursement policy might seem tricky, especially for small businesses. There is a lot to keep track of—IRS rates, state laws, employee documentation. But it does not have to be a headache. MileageWise offers smart solutions designed to simplify this entire process for employers, small businesses, and employees.

How MileageWise Makes Reimbursement Easy

MileageWise gives you the tools to create a seamless system to track and report company mileage.

Mobile App for Employee Mileage Tracking

- Automatic Mileage Tracking: Employees log business drives automatically.

- Quick Employee Setup: Simple onboarding makes it easy to roll out mileage tracking across the team without delays.

- Direct Dashboard Sync: Trips sync to the shared dashboard automatically, ensuring managers have up-to-date data for review.

- Policy-Friendly Trip Categorization: Optimized business trip categorization, supporting internal mileage reimbursement rules.

- Backup Mileage Capture: Ensures trips aren’t missed due to phone settings or signal issues, reducing gaps in reimbursement records.

Dashboard for Team Mileage Management

- Centralized Team Dashboard: Review all employee mileage in one place.

- Bulk Imports: Bring in client lists, trip spreadsheets, and Google Timeline trips taken by car for a smooth transition. The system handles distance calculations.

- Efficient Trip Management: Batch editing and recurring route handling simplify oversight for teams with frequent business driving.

- Bulk Mileage Exports: Export mileage data in bulk to support reimbursements, payroll processing, and internal policy documentation.

- IRS Compliance Check: Automatically reviews logs against IRS guidelines, helping reimbursement records stay audit-ready and consistent.

Try MileageWise for free for 14 days. No credit card required!

Customer Story: Making Our Mileage Policy Work

As a fleet and operations manager, creating a clear mileage reimbursement policy was only half the job. The real challenge was making sure our team actually followed it. Employees were driving daily, but mileage logs were inconsistent, and reimbursements often raised questions.

However, MileageWise helped us turn policy into a working system. Employees track trips automatically, and everything flows into a shared dashboard. I can review, categorize, and approve mileage in line with our reimbursement rules without chasing people for missing details. The IRS compliance check adds confidence that our policy is being applied consistently and correctly.

MileageWise made our mileage reimbursement policy easy to follow, easy to manage, and fair for everyone involved.

Final Thoughts

A well-crafted mileage reimbursement policy is a win-win. It simplifies things for your business and ensures your employees get fair compensation for their hard work. By keeping this guide in mind, you can build a solid mileage reimbursement policy that benefits your entire team and keeps your business running smoothly.

FAQ

Who is eligible to get reimbursed?

Typically, W‑2 employees who drive their personal vehicle for business errands, client visits, or between job sites. Independent contractors usually factor vehicle costs into their fees unless your contract says otherwise.

Can I use allowances, gas cards, or company cars instead of mileage?

Yes. Flat car allowances are usually taxable unless you track and substantiate miles; IRS‑approved FAVR programs and the actual‑expense method are alternatives but more complex. If you pay the mileage rate, don’t also pay for gas, as that double counts.

How should I reimburse employees for mileage?

Employers typically reimburse employees by paying a set rate per business mile driven, often based on the IRS standard mileage rate. Employees must track business trips and submit mileage logs, which are then reviewed and reimbursed according to the company’s mileage reimbursement policy.

Is car allowance or mileage reimbursement better?

Mileage reimbursement is often better for accuracy and fairness because employees are paid based on actual business miles driven. Car allowances are fixed payments and are usually taxable, which can lead to overpayment or underpayment compared to mileage reimbursement under a clear policy.

What does the mileage rate cover?

The rate is meant to cover fuel, maintenance, depreciation, insurance, and normal wear‑and‑tear. It does not cover parking, tolls, or traffic tickets. Parking and tolls are usually reimbursed separately if business‑related.

Do state laws affect comapany policy?

Yes. Some states (for example, Illinois) require employers to cover necessary business expenses, which can include mileage. Make sure your policy meets or exceeds local law.