Mileage Log Generator Guide

Home » Mileage Reimbursement Basics » Company Mileage Log

Last Updated: January 14, 2026

A company mileage log is a must-have for any business reimbursing employees for driving. It’s a detailed record of every business trip your employees take, and it’s the key to keeping your reimbursements tax-free and your company safe from IRS audits. Whether you’re considering a new employee mileage reimbursement program or just want to make sure your current one is up to date, understanding these logs is crucial. They protect your business from unnecessary taxes and make sure your employees are paid fairly.

Table of Contents

What Makes a Company Mileage Log IRS-Compliant?

To avoid problems with the IRS, your company’s mileage logs need to be accurate and complete. The IRS isn’t shy about checking these records. In fact, most audits related to vehicle deductions often come down to vague or incomplete mileage logs. So, what exactly do you need to include?

Essential Elements for Each Trip

Every single business trip your employees make needs specific details recorded. Think of it like telling a complete story about the trip.

Here’s what the IRS absolutely requires:

- Date and Time: When did the trip happen? This proves the trip was timely recorded.

- Start and End Locations: Where did the trip begin and end? This verifies the actual places visited or the route taken.

- Business Purpose: Why was the trip made? This is critical for showing it was for business, like “client meeting” or “delivery to site X.” Vague descriptions like “business” won’t cut it, because the trip also has to be necessary.

- Total Miles Driven: How far did the employee drive? This is the core number for calculating reimbursements. You can get this from odometer readings or reliable tracking methods.

- Odometer readings: It is not necessary to write them down after every trip, but recording yearly odometer readings helps prove the actual distances the car has traveled for business.

Why These Details Matter

Leaving out any of these elements can cause big headaches. The IRS needs to see clear proof that the mileage was for business. If your logs are incomplete, those reimbursements could be seen as taxable income for your employees, and your business could lose out on valuable tax deductions. This is why many companies now look for automated solutions to ensure accuracy.

The Importance of Timeliness and Retention

Logging trips right after they happen, or even daily, is best. If you wait too long, it’s easy to forget details, and recreated logs often don’t stand up to IRS scrutiny. The IRS expects these logs to be made at or near the time of the business use.

On top of timely logging, your business also needs to keep these records. The IRS generally requires you to retain these records for at least 5 tax years after filing your deductions. Many companies choose to keep them even longer, often 4 to 7 years, just to be safe. It is the employer’s responsibility to keep these records, not just the employees’.

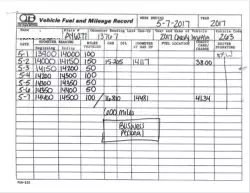

Here are samples of company mileage reimbursement forms that fit into an accountable plan:

Why a Top-Notch Company Mileage Log Benefits Your Business

Having a solid company mileage log system in place offers big advantages. It’s not just about avoiding IRS trouble; it’s also about saving money and making your operations smoother.

Audit Protection and Cost Savings

First and foremost, detailed logs are your best defense against an IRS audit. If auditors question your vehicle deductions or employee mileage reimbursements, you’ll have clear, verifiable records to back up every dollar. Without them, you risk having deductions disallowed, which means more taxes for your business. Estimates alone simply won’t pass IRS scrutiny.

Good logs also help control costs. When reimbursements are tied directly to actual miles driven for business, you prevent overpaying employees. This precision can lead to significant savings. In fact, some businesses have seen a 20-30% reduction in vehicle-related expenses by moving away from flat stipends to more precise mileage tracking. This is especially true when using programs like Fixed and Variable Rate (FAVR) allowances, which rely on accurate mileage data.

Boosted Employee Satisfaction and Efficiency

Believe it or not, a well-run mileage program can actually make your employees happier. When they know their mileage for work will be accurately tracked and reimbursed tax-free, it’s a big plus. It means less manual paperwork for them and more certainty about their paychecks. This can reduce frustration and help keep valuable mobile employees from looking elsewhere for work.

On the operational side, modern systems, especially app-based ones, drastically cut down on administrative time. Companies using automated tracking have reported up to an 80% reduction in admin time. This frees up your accounting and HR teams to focus on more important tasks. Automated systems also integrate with payroll, making the whole reimbursement process seamless and efficient. They can even flag personal use of company vehicles, helping you manage fringe benefits and avoid tax complications.

MileageWise: Your Solution for an IRS-Proof Company Mileage Log

Now that you understand the importance of a compliant company mileage log, let’s talk about how to achieve it easily and accurately. This is where MileageWise steps in. Our solutions are designed specifically for businesses like yours, making mileage tracking effortless and IRS-proof.

Mobile App for Employee Mileage Tracking

- Automatic Mileage Tracking: Employees capture business drives automatically, keeping mileage records aligned with company reimbursement rules.

- Simple Team Rollout: Quick setup makes it easy to introduce mileage tracking across the organization without lengthy onboarding.

- Live Dashboard Sync: Trips sync instantly to the company dashboard, giving managers timely visibility for reimbursement review.

- Clear Business Trip Classification: Business mileage is clearly separated and organized, supporting internal policies and consistent reimbursements.

- Reliable Backup Capture: Ensures mileage is recorded even when tracking is interrupted by phone settings, low battery, or busy workdays.

Dashboard for Company Mileage Oversight

- Centralized Mileage Management: View and manage all employee mileage in one place, making policy enforcement consistent across the company.

- TBulk Imports: Upload client lists, trip spreadsheets, and Google Timeline drives. Distances are automatically calculated to save time.

- Efficient Log Management: Batch editing and recurring route handling reduce administrative effort for high-driving teams.

- Bulk Mileage Exports: Export approved mileage data to support reimbursements, payroll processing, and internal mileage reports.

- IRS Compliance Check: Automatically reviews comapny mileage logs against IRS guidelines to help company records stay audit-ready.

Try MileageWise for free for 14 days. No credit card required!

“Keeping a company mileage log used to be one of our most time-consuming admin tasks. Drivers submitted notes late, spreadsheets were inconsistent, and reconciling mileage for reimbursement often raised questions. We needed a system that worked for both employees and management.

With MileageWise, our mileage logs is now built automatically from real trips. Employees track mileage without extra effort, and everything flows into one shared dashboard. I can review, adjust, and approve logs quickly, knowing the data supports our reimbursement policy and IRS guidelines.

What used to be a monthly headache is now a simple, reliable process we can trust.”

Conclusion: The Smart Way to Track Miles

A company mileage log is more than routine paperwork. It helps protect your business during audits, reduces tax risk, and supports fair employee reimbursements. To stay compliant, it’s important to understand IRS requirements, use a reliable tracking tool, and make sure employees log trips correctly. A clear reimbursement policy and regular reviews help catch issues early, while keeping records for several years ensures you’re covered if questions come up later.

FAQ

How long should my company keep mileage logs?

Keep them at least 3 years after filing the return or reimbursing the expense. Many companies keep 4–7 years to match broader record-retention and audit periods.

How should I reimburse employees?

It is best to pay the logged business miles at your chosen rate (often the IRS standard rate) under an accountable plan with timely submissions. Consider FAVR or Actual expense reimbursement depending on your business.

Does the IRS mileage rate include parking and tolls?

Tolls and parking are separate from the mileage rate and can be reimbursed in addition. Require receipts for those extras.