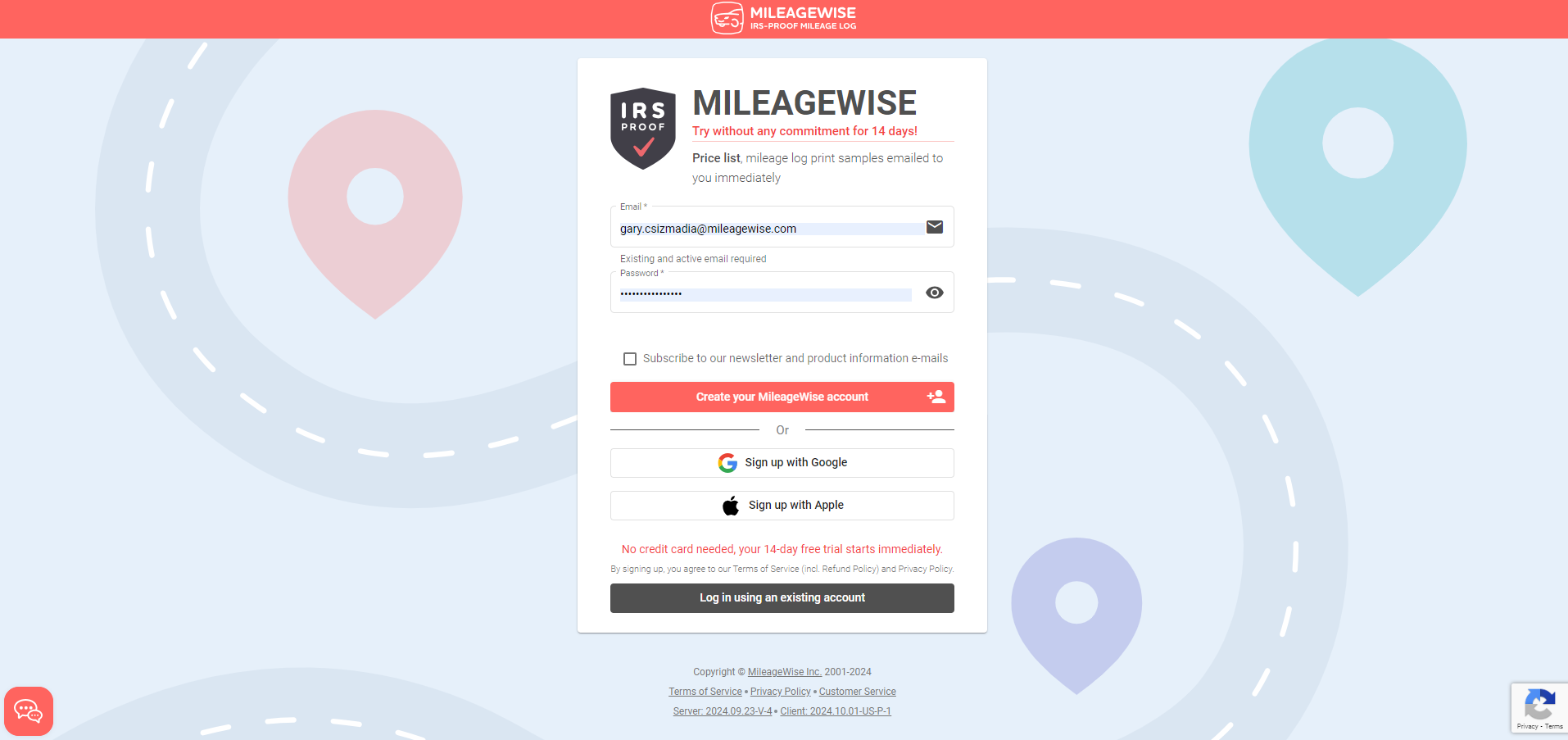

Choose your email address and password, then click on ‘Create your MileageWise account’.

Alternatively, you can now sign up using your Google or Apple account with our new social login options for a faster and easier registration process.

Congratulations, you have successfully created your MileageWise account! You can head straight to the Web Dashboard or just wait 10 seconds to be automatically redirected there.

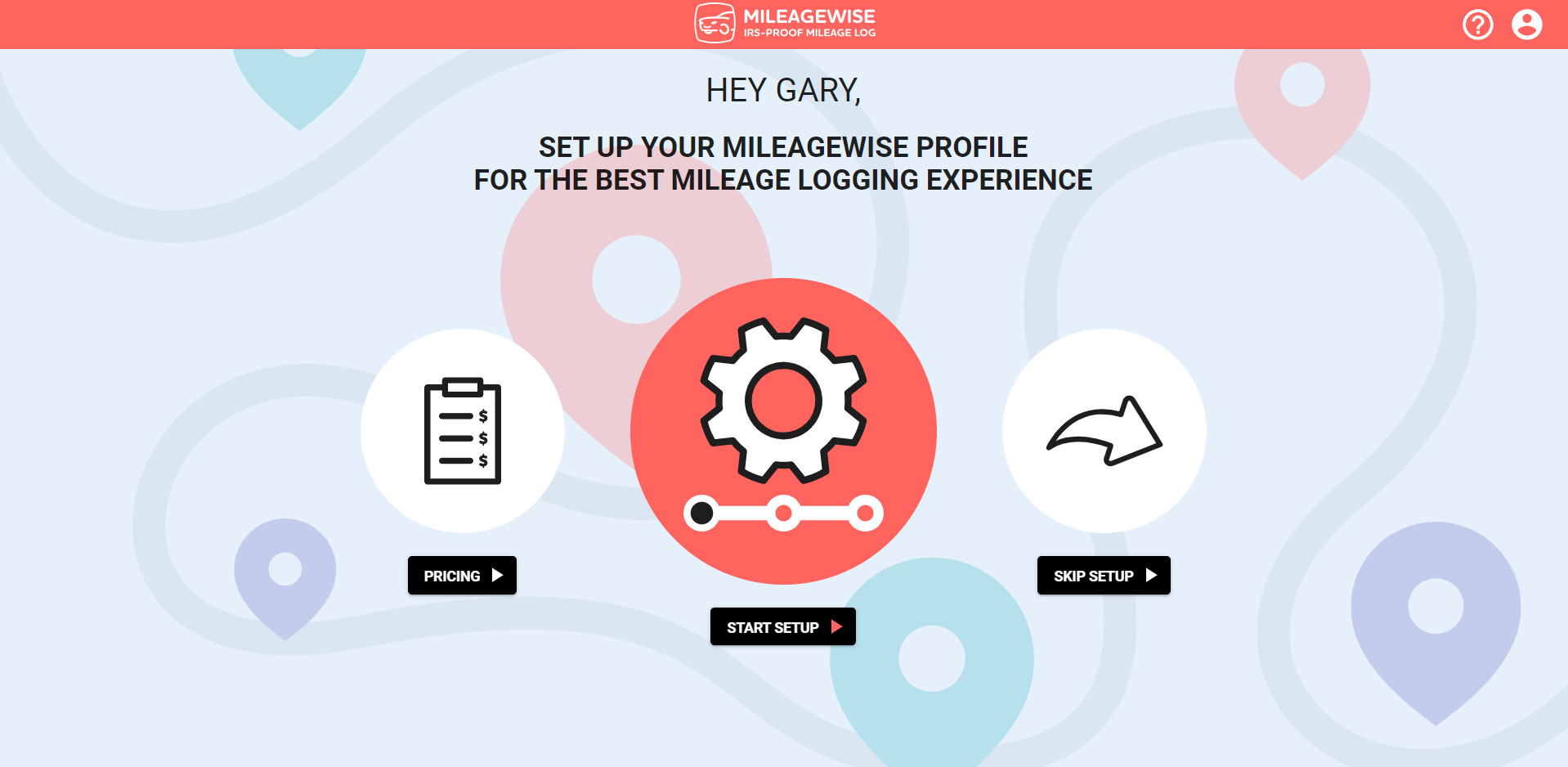

Start the setup process now for the best mileage logging experience.

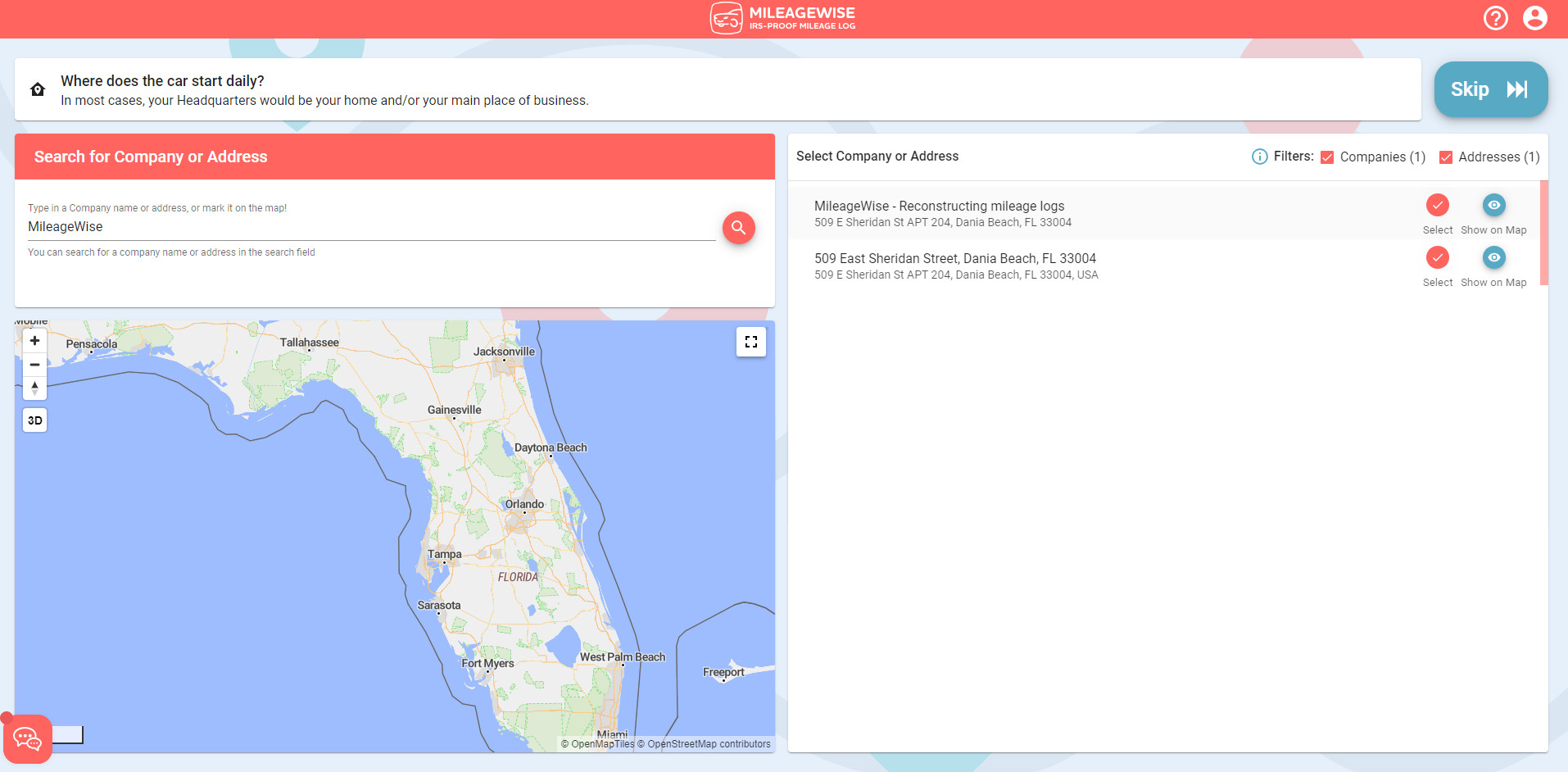

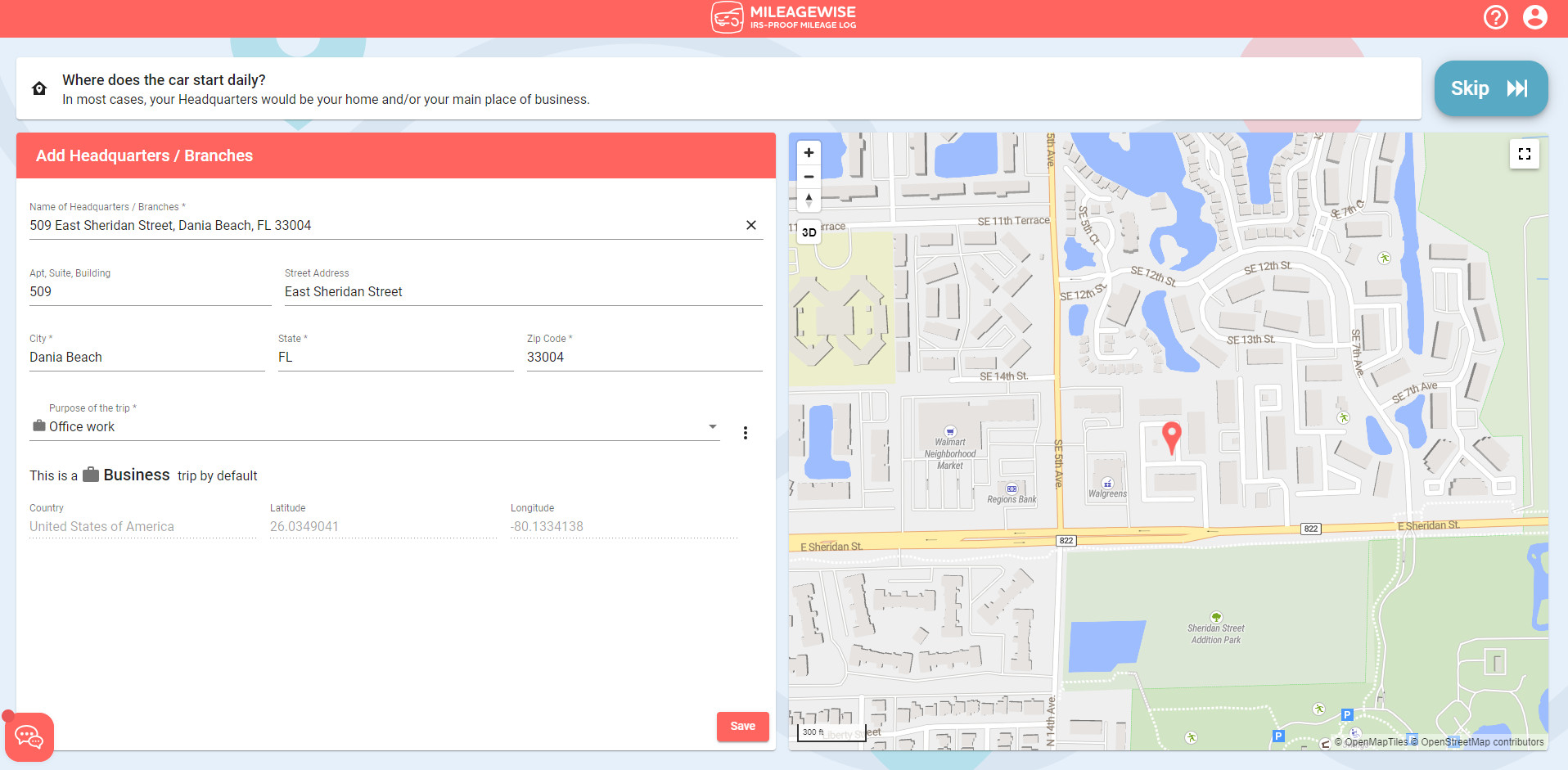

The first step is to add your HQ / Branch. In most cases, this would be your home address and/or principal place of business.

Use the search bar and then choose from the results on the right-hand side by clicking the red “Select” button.

Review the address data and then click the red “Save” button to continue.

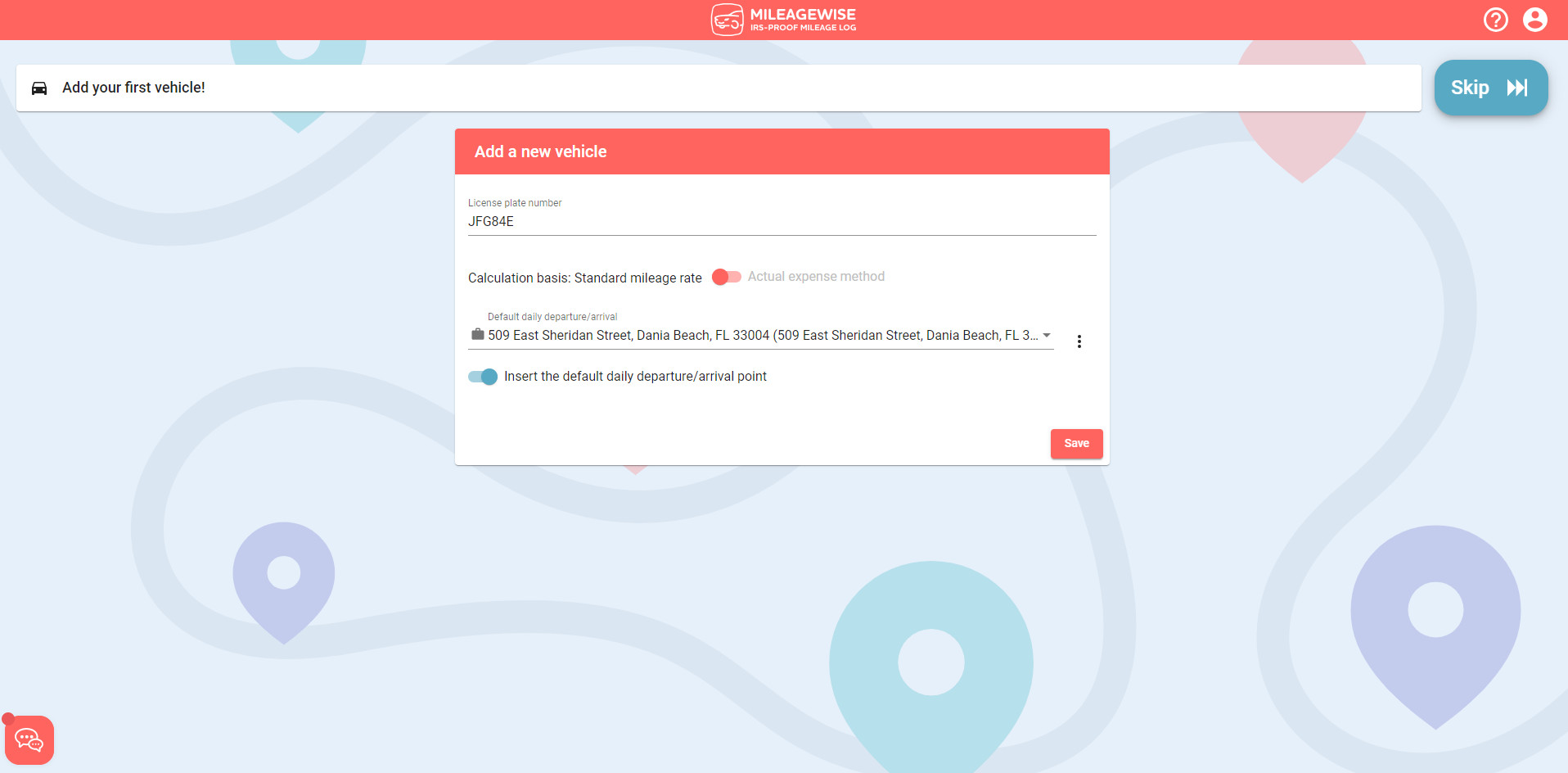

The last step of the setup process is to add your first vehicle.

Click the red “Save” button to continue.

Now you’re all set to start creating your IRS-Proof mileage logs.

For future ease of access, bookmark both our website and the web dashboard.