IRS Mileage Log Guide

Home » IRS-Compliant Mileage Log » Daily Mileage Log

Last Updated: June 25, 2025

A contemporaneous log is your golden ticket to significant tax deductions and proper business reimbursements. It’s an essential record of your vehicle usage, especially for business owners, freelancers, and anyone using their car for work. This guide will walk you through everything you need to know to track your miles accurately and stay IRS compliant. In addition, it will provide you with a daily mileage log.

Table of Contents

Why a Daily Mileage Log is Crucial for Your Finances

Keeping a mileage log isn’t just a suggestion; it’s a requirement from the IRS if you want to claim vehicle-related business expenses. Without proper documentation, you risk losing thousands in deductions and facing hassles during an audit.

The Power of Proper Documentation

For starters, the IRS mandates specific details for every business trip you claim. This includes the date, the destination, the business purpose of the trip, and the total miles driven. Additionally, your information, your vehicle’s information, and your starting and ending odometer readings for the year. Sounds like a lot, right? Well, it is, but it pays off significantly. Without a log, you leave money on the table.

Avoiding Audit Woes

Beyond the financial benefits, a robust contemporaneous mileage log offers peace of mind. The IRS does conduct audits, and one of the first things they’ll ask for is your mileage records if you’ve claimed car expenses. A well-maintained log demonstrates diligence and compliance, significantly reducing your audit risk. Watch this video for a visual explanation of the importance of contemporaneous mileage logs.

Who Benefits Most from a Daily Mileage Log?

If you fall into any of these categories and you drive around for work, a meticulous contemporaneous mileage log is non-negotiable:

- Self-Employed Professionals: Consultants, real estate agents, direct sellers.

- Small Business Owners: Delivery services, contractors, mobile service providers.

- Gig Economy Workers: Rideshare drivers, food delivery personnel, couriers.

- Employees Seeking Reimbursement: Sales professionals, field technicians.

Contemporaneous vs. Monthly Mileage Log

The IRS strongly prefers contemporaneous logging, meaning you record your mileage at the time of the trip or very soon after. This is because memories fade, and estimates are a red flag for auditors. While you can technically log monthly, it’s far riskier. Digital solutions make contemporaneous logging effortless, automatically tracking your trips as you drive.

How to Set Up Your Daily Mileage Log for Success

Setting up your IRS-compliant mileage log doesn’t have to be complicated. Whether you prefer pen and paper or digital solutions, the key is consistency and attention to detail.

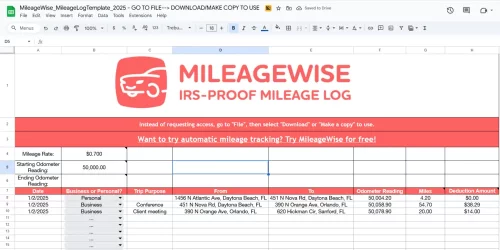

Download MileageWise’s Free Daily Mileage Log Formats here:

Manual vs. Digital: Which is Right for You?

While some prefer a physical notebook, the trend is moving towards digital. In fact, more and more businesses sign up for digital mileage tracking services, saving more time and money compared to manual methods. This shift is clearly for efficiency but also for accuracy.

Feature | Manual Log | Digital Log |

Accuracy | Prone to human error, estimates | High (GPS-based, automated) |

IRS Compliance | Requires diligent updating; can be lost | Meets IRS standards, audit-proof reports |

Time Required | High (manual entry, calculations) | Low (automatic tracking and reports) |

Cost | Very low (notebook, pen) | Moderate (app subscription) |

Additional Benefits | None | Cloud backup, easy edits, instant reports |

MileageWise: Your Partner in Efficient Mileage Tracking

Once you understand the ‘why’ and ‘what’ of mileage logging, it’s time to choose the ‘how.’ This is where MileageWise steps in, transforming a potentially tedious task into an effortless, accurate, and IRS-compliant process.

MileageWise is built for accuracy, efficiency, and compliance. Our mobile app ensures you capture every deductible mile without the headache. How do we do it?

- Automatic Mileage Tracking: Easily track your daily drives with several recording modes to fit how you work and travel.

- Quick Setup: Get up and running in minutes so you can start logging your daily trips without hassle.

- Ad-Free & Privacy-Focused: Enjoy an app that’s free of ads and keeps your personal data secure.

- Backup Mileage Capture: Accurately pinpoints your starting point each day, helping avoid gaps other trackers might miss.

- Flexible Routing/Distance Calculations: Pick between recording your actual routes or using calculated distances to save battery during everyday use.

- Routing Integration with Waze: Let Waze handle navigation while MileageWise quietly logs your daily trips in the background.

- Expense Tracking Integration: Keep track of both mileage and expenses daily, all in one place for easy management.

- Comprehensive Support: We believe in empowering our users. That’s why you get access to a dedicated customer support team and a wealth of resources to guide you.

- Lifetime Plans: We know the value of long-term savings. MileageWise is the only company in the industry to offer lifetime plans, meaning you pay once and never worry about recurring fees.

Our technology is designed to create that perfect daily mileage log automatically. Forget manually calculating routes or estimating distances. Our system ensures your logs are audit-proof and ready for tax season.

Try MileageWise for free for 14 days. No credit card required!

Customer Story: How MileageWise Saved Me $1,000s

I’m a freelance caterer. My car is my office on wheels. I drove daily to venues, supply runs, errands, you name it. For years, I took my daily mileage log lightly. Then tax season would come around, and I’d spend hours trying to reconstruct everything and still feel like I was losing money. Even worse, a photographer I know once got audited over an inconsistent log. Yikes. Then a friend told me about MileageWise. I was skeptical. Another app, another subscription… But the lifetime plan won me over. The setup was easy, and now it auto-tracks my drives and even categorizes my trips. Last tax season? I tapped “generate report” and got a clean, IRS-compliant log. The app logged over 8,000 more miles than I ever did before. I thought these tools were for big businesses, but it turns out, even creatives like me need them too.

Conclusion and Your Next Steps

Maintaining an accurate contemporaneous mileage log is not just about compliance; it’s about optimizing your tax deductions and gaining financial control. Whether you’re a freelancer, a small business owner, or simply want to maximize your reimbursement, proper mileage tracking is essential.

Here’s your action plan:

- Understand the Requirements: Know what the IRS demands for a valid mileage log.

- Choose Your Method: Decide if you’ll go manual or digital for efficiency and accuracy.

- Start Logging Today: Consistency is key. Implement your chosen method immediately.

- Embrace Automation: Consider a solution like MileageWise for effortless tracking and robust reporting.

- Review Regularly: Periodically check your logs for accuracy and completeness.

- Retain Records: Store your logs securely for at least three years after filing for a deduction.

By taking these steps, you’ll be well-prepared for anything tax season throws your way, ensuring you get every penny you deserve.

FAQ

Can I use a mileage tracking app instead of a paper log?

Yes. The IRS accepts digital mileage logs as long as they contain all required details and are backed up. Popular apps include Everlance, MileIQ, and MileageWise, which automatically record trips and generate compliant logs.

Are there free templates available for daily mileage logs?

Yes. You can find free daily mileage log templates as downloads for Excel, Google Sheets, or printable PDFs. Microsoft Office, Google Docs template gallery, various accounting sites, and this blog offer ready-to-use templates.

Can I claim mileage for commuting to my regular workplace?

No. Commuting mileage (the distance from home to a regular place of work) is NOT deductible according to IRS rules. Only business-related travel away from your regular workplace is eligible.

Is a daily mileage log better than a monthly mileage log?

Yes, a daily mileage log is better because it’s more accurate for proving business use. Monthly mileage logs risk missing trips or details, while daily entries help create a clear, contemporaneous record.

Can I edit or recreate a mileage log at the end of the year if I forgot to keep one?

Reconstructing a log from memory or using estimates is not recommended and may not hold up in an audit. However, if you do end up without a mileage log, MileageWise offers a range of solutions for retroactive mileage logging.

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |