Calculate how much money you can get back with IRS-Proof mileage logs:

FRAGMENTED MILEAGE LOGS?

If you work for multiple providers of platforms (Uber, Lyft, DoorDash, etc.) you will often be left with fragmented mileage logs. This might mean you cannot account for all the mileage you’ve driven for business purposes. You could lose out on valuable tax deductions! Plus, your mileage log won’t be comprehensive enough to be IRS-compliant.

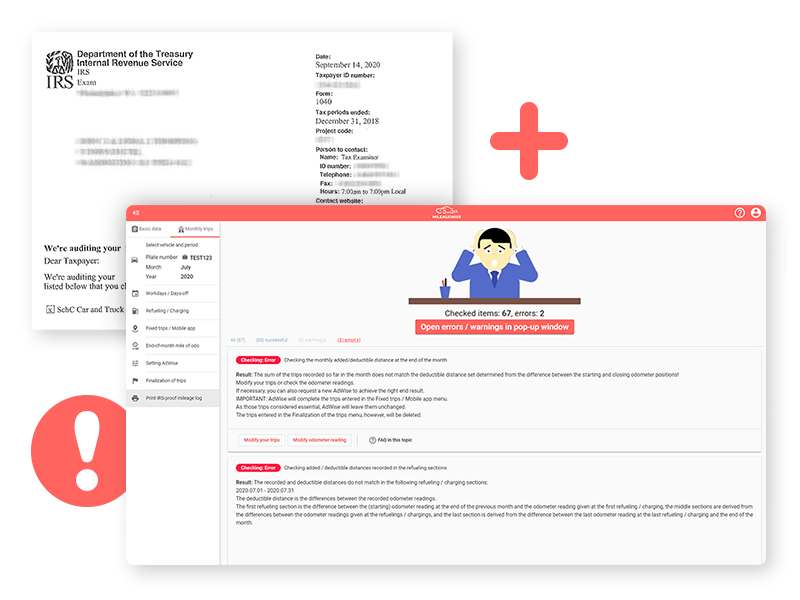

A FINE FROM THE IRS IS NO JOKE!

Your mileage log has to be spotless to avoid a large fine from the IRS, which can also request all of your business data: refueling receipts, proof of business expenses, and odometer readings taken by mechanics or safety inspectors. You need your logs to be bulletproof – you can’t just guess your trips!

MILEAGEWISE TO THE RESCUE

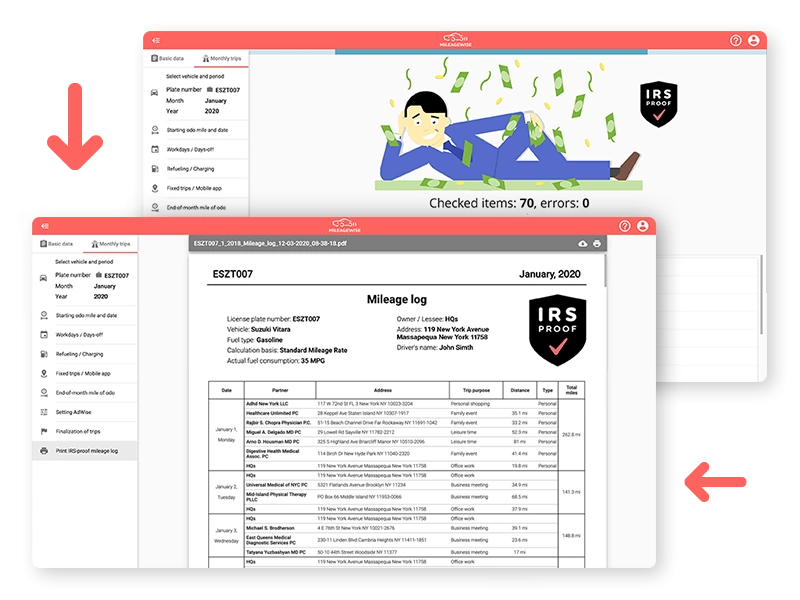

You can log your mileage with MileageWise’s mileage tracker app simultaneously with the other apps that you use, or import any pre-existing mileage logs into the web dashboard, where our AI Wizard feature gives you an automatic recommendation for any gaps you might have in your current mileage log.

MAX OUT YOUR TAX DEDUCTIONS!

In the process, the built-in IRS auditor checks and corrects 70 logical conflicts for you so your final MileageWise mileage log will be flawless and IRS-proof! Take advantage of our 14-day Free Trial period, and try ALL of our unique features! By saving yourself from the consequences of inaccurate mileage logs, MileageWise becomes the cheapest solution on the mileage log market.