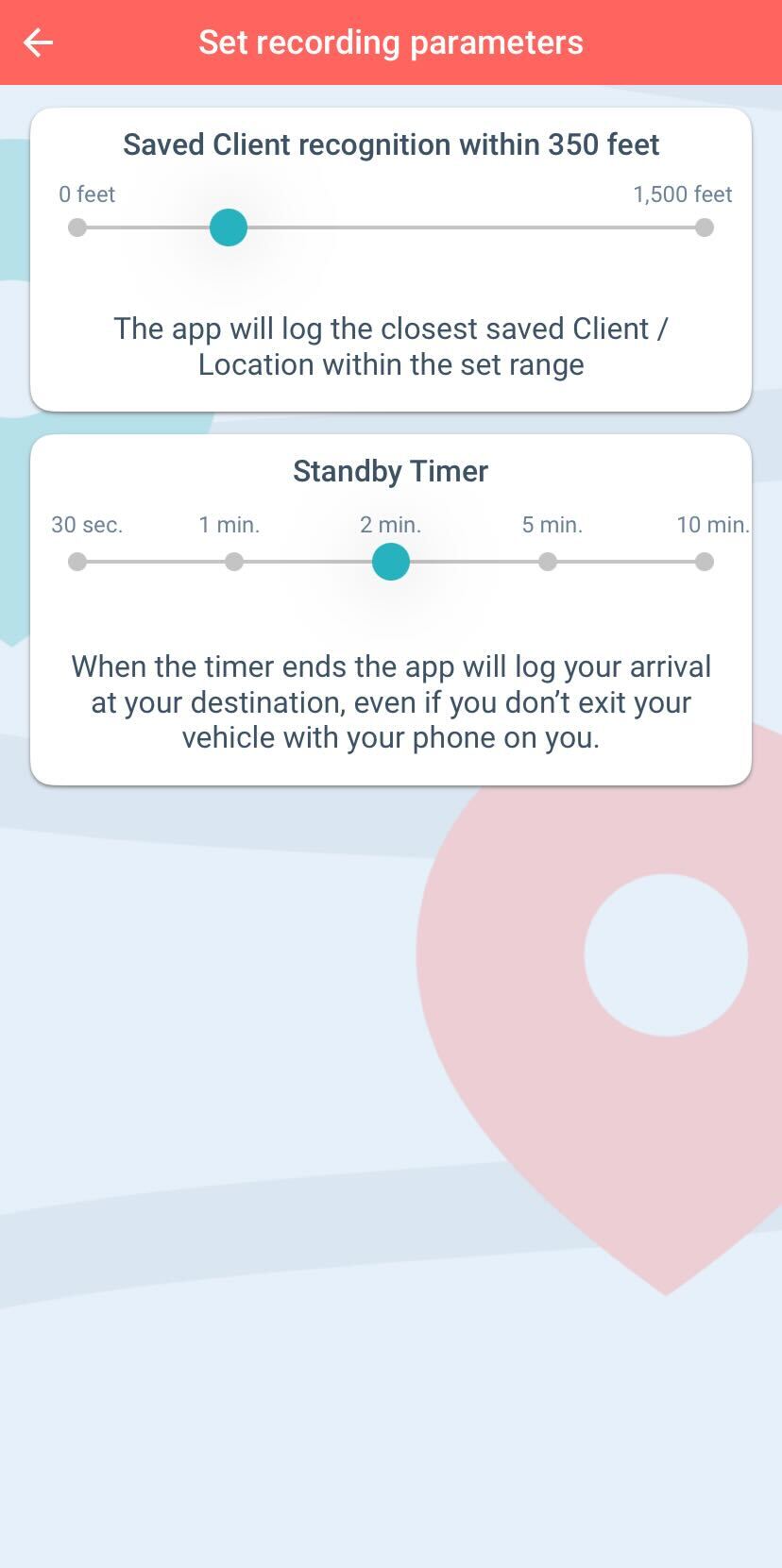

Note: The Standby Timer feature is available exclusively with the Vehicle Movement Monitoring recording option.

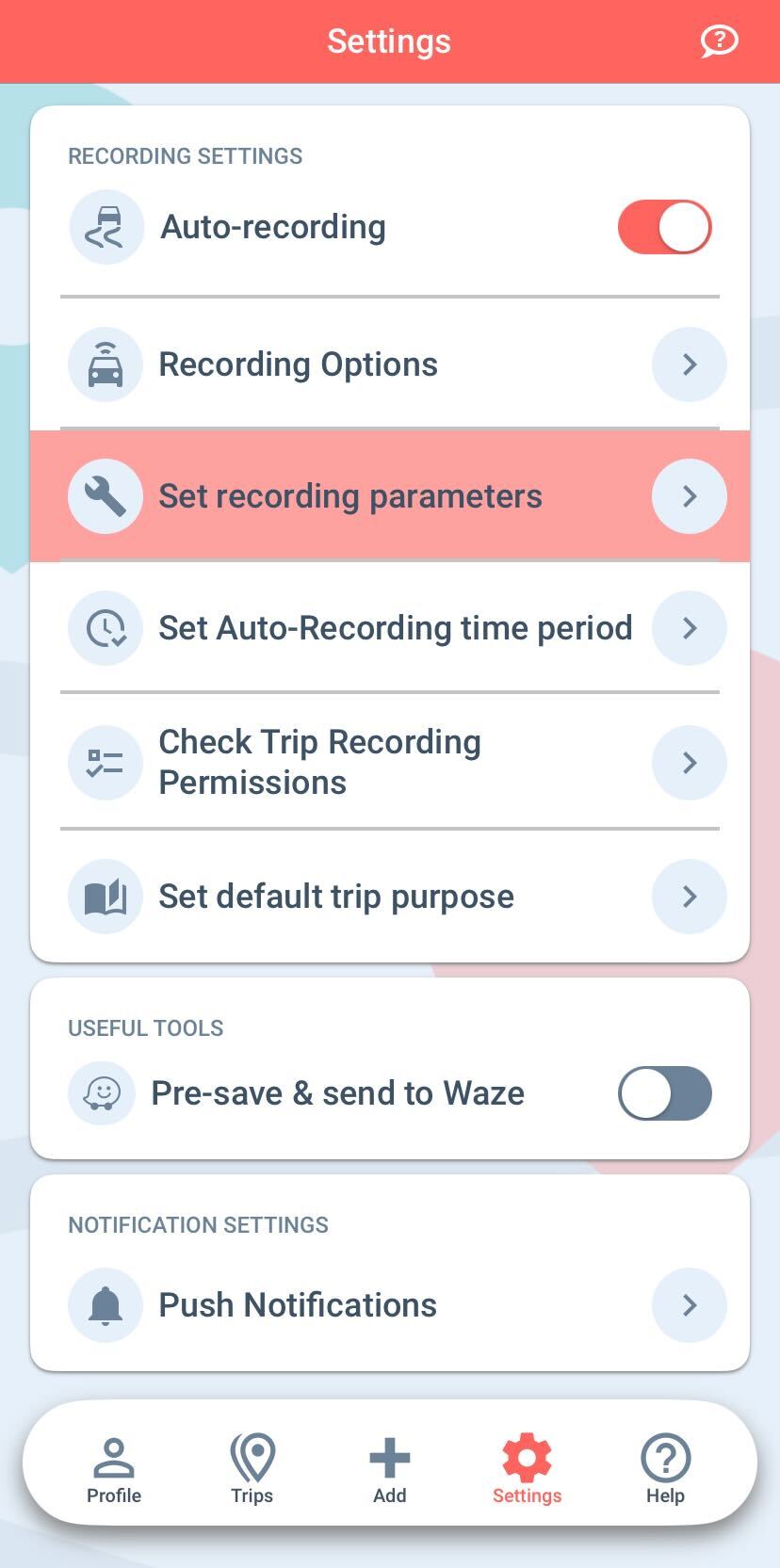

You can access the Standby Timer by going to the Settings menu and selecting Set Recording Parameters under the Recording Settings section.

The Standby Timer automatically logs your trips, even if the usual trigger (exiting your vehicle and walking for about 100 feet) isn’t activated while using Vehicle Movement Monitoring.

If you’re an Uber or Lyft driver picking up a passenger, you might estimate that it takes 2 minutes from the time you stop to when you start driving again. During this time, you didn’t exit your vehicle, and your phone stayed in the car, so the usual triggers weren’t met. The Standby Timer ensures that your trip is still logged automatically, even without those triggers.

This feature is ideal if:

Set the timer based on how long you typically remain idle at each location before starting your next trip. The app will then log your trip automatically after the specified time period.