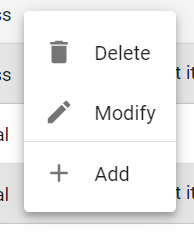

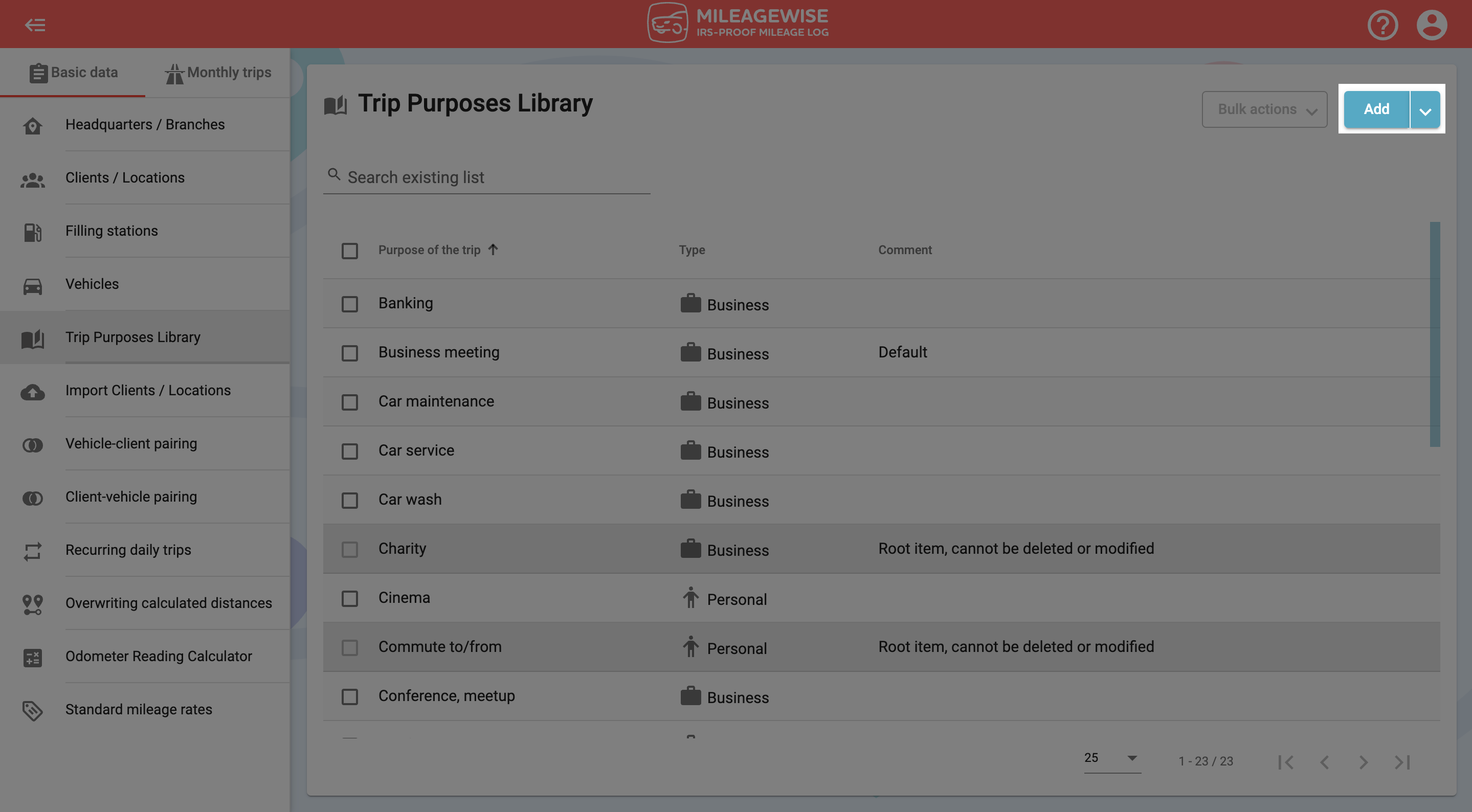

Select the add option in the drop-down menu of the Trip Purposes Library menu in the dictionary area by right-clicking.

Or click on the menu at the top right and select Add.

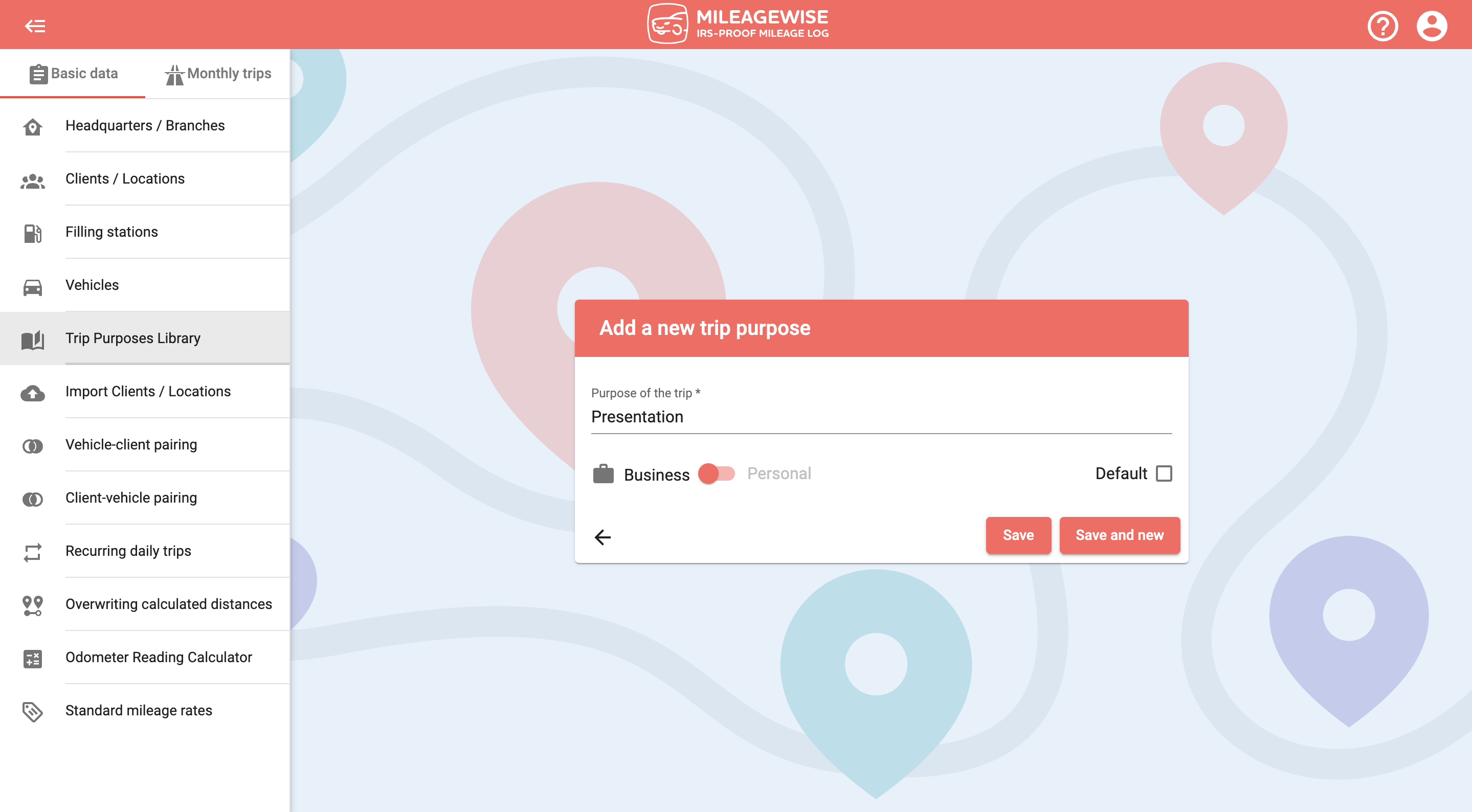

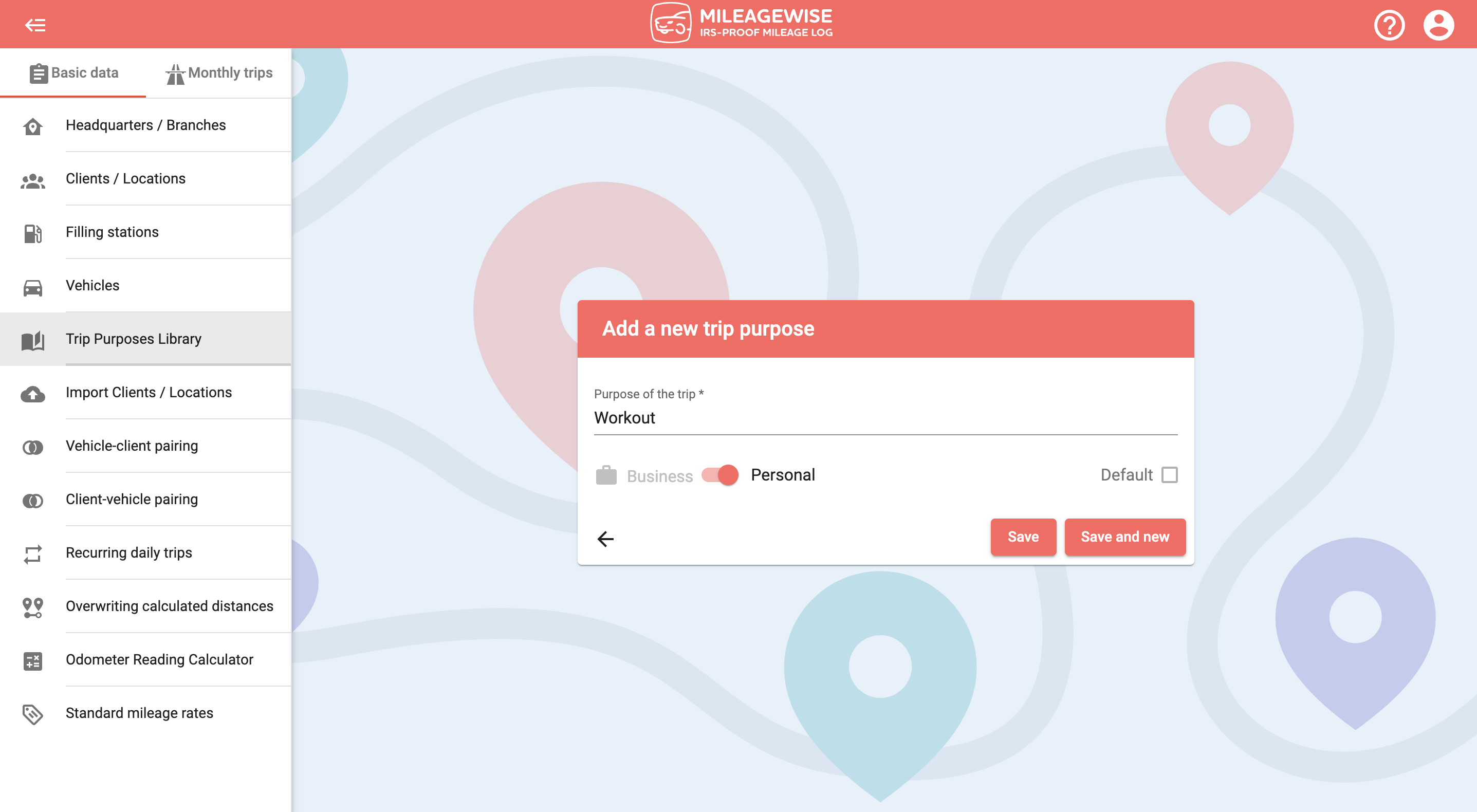

In the next window, enter your new trip purpose!

Be careful whether you set a business or personal purpose. It will determine whether the program records it as a business or personal trip when you visit that client!

If you tick the Default checkbox, when you add a new client, the purpose you marked will appear in the Purpose of the trip field (of course, you can select other purposes from the list).

Click Save to save the new purpose to your dictionary, or Save and new to add another trip purpose immediately.

You can also modify and delete the entered trip purpose.