Home » Real Estate Agents’ Mileage Log

Calculate how much money you can get back with IRS-Proof mileage logs:

UNEASY ABOUT MILEAGE LOGS?

Real estate agents drive a lot, showing homes and meeting clients. However, keeping a detailed mileage log is often overlooked, leading to incomplete records. This missed step costs realtors money and peace of mind at tax time.

IRS AUDIT RISK

Reporting unrealistic mileage can trigger an audit, and without precise mileage logs, real estate agents face serious risks. Imagine having to recall every business trip from months ago.

Furthermore, the IRS can request all of your business records, including expense reports, toll receipts, traffic camera data, and more. If those documents don’t match your mileage logs, you could face a hefty IRS fine!

CHOOSE THE WISEST SOLUTION

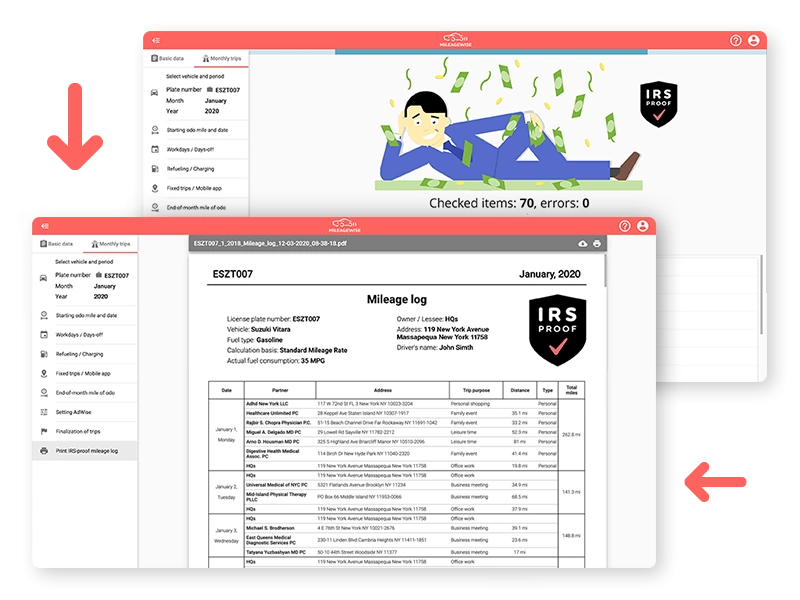

Track your trips with our mileage tracker app or use the web dashboard for retroactive mileage logging.

- Import your Google Location History to recover past trips.

- Just set a few mileage recovery parameters, and our AI Wizard Mileage Log Generator will fill in the gaps.

- The built-in IRS auditor will check and correct 70 potential red flags in your log, delivering a 100% IRS-proof result.

"GREAT, BUT SOUNDS EXPENSIVE..."

Take advantage of our 14-day free trial and explore every unique feature we offer. Next to our subscription-based plans, we also offer Lifetime Deals, unlike any other mileage tracker!

When you can create IRS-proof mileage logs in just 7 minutes a month and avoid costly mistakes with a single lifetime investment, it’s easy to see why MileageWise is one of the most affordable mileage tracking solutions for real estate agents out there.