Mileage Reimbursement Guide

Home » Mileage Reimbursement Basics

Last Updated: January 7, 2026

Mileage reimbursement is how companies repay employees for using their personal vehicles for business. It helps cover costs like gas, maintenance, and wear and tear. Understanding these rules is key for both employers to stay compliant and employees to get fairly paid.

This guide explains what it is, how it works, and why it matters. You’ll learn the main methods, how IRS and state rules apply, what makes mileage taxable or non-taxable, and which records are required for compliance. It also covers best practices for employers, tracking tips, and how to simplify company mileage reimbursement with automated tools.

Table of Contents

What is Mileage Reimbursement?

It means offering employees compensation for using their vehicles for company business. Think of it as fair payment for the fuel, upkeep, and even the depreciation of an employee’s car when they drive it for work. The Internal Revenue Service (IRS) sets standard rates each year, giving businesses a clear guideline for tax-free reimbursements. Employers often use this rate because it simplifies record-keeping and ensures tax compliance, meaning employees can receive these payments without them counting as taxable income.

The Most Common Mileage Reimbursement Methods

Employers have options when it comes to choosing reimbursement methods. Most often, they use the IRS standard rate because it’s straightforward. However, other methods exist too.

Using Mileage Rates

This is the most common and easiest method. Employers simply multiply the number of business miles driven by the IRS rate (or a custom work mileage reimbursement rate). This approach makes it easy for both the company and the employee. This payout is not usually counted as taxable income for employees, as long as it’s part of an accountable plan.

This also means that employees usually only need to keep a log, rather than keeping receipts. Remember, commuting to a regular office does not qualify. However, it’s always best to have a clear company policy to avoid confusion.

Actual Expenses Method

This method involves tracking all actual vehicle-related expenses. This includes gas, oil, repairs, tires, insurance, registration fees, and even depreciation. While it can lead to more accurate payouts, it requires meticulous record-keeping. Employees typically do not use this method, as it’s much more complex to manage.

Fixed and Variable Rate (FAVR) Programs

Some larger companies use FAVR programs. This method pays a fixed amount for certain costs (like insurance and depreciation) and a variable amount per mile for operating costs (like gas). FAVR programs can be more accurate for employees, especially those who drive a lot in varying conditions, but they are more complex to administer. Motus data suggests FAVR can address regional cost differences that the single IRS rate might miss.

Overview of Methods

| Reimbursement Method | Simplicity for Employer | Record-Keeping for Employee | Tax Implications (Employee) | Best For |

|---|---|---|---|---|

| IRS Standard Rate | High | Mileage logs only | Non-taxable (under rate) | Most businesses |

| Actual Expenses | Low | All receipts + logs | Varies (complex) | Not typical for employee reimbursement |

| FAVR Programs | Medium | Mileage logs + some records | Non-taxable (if compliant) | Companies with varied driver needs |

Federal vs. State Rules on Mileage Reimbursement

Understanding the legal requirements can be tricky because it’s not federally mandated in all cases.

Federal Standpoint

The federal government doesn’t generally require employers to reimburse for mileage. However, there’s a big exception: if refusing to reimburse an employee for necessary business expenses (like business miles) would cause their pay to fall below the federal minimum wage, then the employer must reimburse them. This protects low-wage workers.

State-Specific Laws

Many states have stricter rules. For example, California, Massachusetts and Illinois explicitly require employers to reimburse employees for “necessary business expenses,” which includes miles for using a personal vehicle for work. It’s important for employers to check local and state laws, as they can vary greatly.

Best Practices for Employers

Even if not legally required, offering mileage compensation is considered a best practice. Expensing mileage helps attract and retain good employees, promotes fairness, and ensures employees aren’t losing money while working for the company. Using IRS-recommended rates helps streamline tax reporting for both parties.

Taxation of Business Mileage Reimbursement

Understanding the taxation of car allowance is vital for both employees and the companies they work for. Getting this right prevents unexpected tax bills.

Accountable Plans

For work mileage reimbursement to be non-taxable income for an employee, it must be part of an “accountable plan.” This means the expenses must be related to business, employees must provide adequate records within a reasonable time, and any excess payout must be returned. If these conditions are met, the amount at or below the IRS standard rate is generally not taxable to the employee and is tax-deductible for the employer.

Excess Payments

If an employer reimburses more than the IRS standard rate, or doesn’t follow the “accountable plan” rules, the excess amount is usually considered taxable wage income for the employee. This means it will show up on their W-2 and be subject to income tax withholding and payroll taxes.

W-2 Employees and Unreimbursed Expenses

For W-2 employees, and due to tax law changes, you cannot deduct unreimbursed employee business expenses on your federal tax return.

Self-Employed Individuals

Self-employed individuals have different rules. They can deduct business miles either by using the standard mileage rate or by tracking actual expenses. However, they cannot mix methods for the same vehicle in the same year if they choose to claim actual expenses after using the standard rate in prior years.

IRS Compliance

The IRS is serious about proper documentation. Without solid, audit-proof mileage logs, both employers and employees could face issues during an audit. This is where detailed record-keeping and robust tracking solutions become invaluable.

Essential Records and Tracking Tips for Mileage Reimbursement

Without accurate record-keeping, employees risk not getting paid fairly, and employers risk non-compliance.

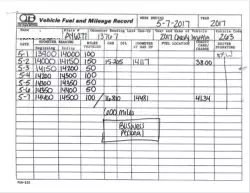

What to Record

For each trip, you need to log the date, the purpose of the trip (e.g., “client meeting at ABC Corp”), the starting and ending locations, and the total miles driven. It’s also wise to note the odometer readings at the beginning and end of the year. Don’t forget to keep receipts for any tolls or parking fees, as these are typically reimbursed separately from mileage.

Methods of Tracking:

- Manual Logs: This means writing down every detail in a notebook or on a spreadsheet. While simple, it’s very prone to human error and can be forgotten.

- Spreadsheets: Using a digital spreadsheet template can be more organized than a physical notebook, but still requires manual input for each trip.

- Automatic Mileage Tracking Apps: These apps, like MileageWise, automatically record your drives using GPS. They save a lot of time, reduce errors, avoid employee expense fraud, and often generate IRS-compliant reports.

The Importance of Contemporaneous Records

The IRS prefers “contemporaneous records,” meaning you record the miles at or around the time of the trip. Waiting until tax season to guess your mileage is a huge red flag during an audit. Consistent and timely tracking is much more reliable and defensible.

Employer Policies

Employers should clearly outline their required tracking methods and documentation in their reimbursement policy. This consistency helps avoid disputes and ensures all employees follow the same rules.

Streamlining Mileage Reimbursement with MileageWise Solutions

Managing mileage reimbursement doesn’t have to be a headache. Businesses, especially small and medium-sized ones without large accounting departments, benefit greatly from automated solutions like MileageWise. Our tools are designed to simplify tracking, ensure accuracy, and guarantee IRS compliance.

MileageWise offers two main products that work together to cover your mileage tracking needs:

Mobile App for Employee Mileage Tracking

- Automatic Mileage Tracking: Employees can capture business trips automatically to avoid the daily manual effort and harmful expense fraud.

- Quick Setup for Drivers: Simple onboarding helps teams start tracking fast, even across many employees.

- Sync with the Shared Dashboard: Trips flow into the dashboard for review, edits, and reporting, keeping the team aligned in one place.

- Automatic Categorization: Keep business drives clearly separated and organized, supporting internal and IRS rules for mileage reimbursement.

- Backup Mileage Capture: Adds reliability when a phone setting, low battery, or a busy day causes missed tracking.

Dashboard for Team Mileage Management

- Shared Team Dashboard: Manage all employee mileage in one place, with clear visibility across drivers and vehicles.

- Bulk Imports: Import client lists, trip spreadsheets, and even Google Timeline drives to ease transition. The system automatically calculates distances.

- Review & Trip Management: Batch-edit, categorize, and handle recurring routes efficiently, ideal for high-volume driving teams.

- Bulk Exports: Export mileage data in bulk to support reimbursements, bookkeeping, and internal reporting.

- IRS Compliance Check: Checks logs against IRS rules to help keep company records audit-ready and consistent.

Try MileageWise for free for 14 days. No credit card required!

Customer Story: Managing Team Mileage Without the Headache

I run a small service business with several employees on the road every day, so mileage tracking used to be one of my biggest pain points. Trips came in late, logs were incomplete, and I spent way too much time chasing details before payroll and reimbursements.

MileageWise changed that completely. My employees track their drives automatically, and I can see everything in one shared dashboard. I have access to employee trips and mileage anytime, which makes reviewing, exporting, and staying organized much easier. Instead of guessing or fixing errors at the end of the month, I finally feel in control of our mileage records.

What really stood out to me, though, was the customer support. Whenever I had a question, I got a quick, clear reply from someone who actually understood how businesses with employees work. No long waits, no copy-paste answers. Just practical help when I needed it.

Conclusion and Your Next Steps

Accurate and compliant mileage reimbursement is critical for businesses and employees alike. It ensures fair compensation, prevents tax issues, and keeps everyone happy. Leveraging modern, automated solutions is no longer a luxury but a necessity for efficient operations. Here are your actionable steps:

- Educate your employees on what constitutes business vs. non-business mileage and put it in writing.

- Maintain meticulous, IRS-compliant records for all business travel.

- Implement a robust mileage tracking system.

- Consider an automated solution like MileageWise to ensure accuracy, compliance, and efficiency in your mileage reimbursement process.

FAQ

Is mileage reimbursement requirement by law?

There’s no general federal rule that requires expensing mileage for employees. Employers must still ensure pay doesn’t drop below minimum wage after business expenses. Some states (for example, California and Illinois) require reimbursement of necessary business expenses.

Can W‑2 employees deduct mileage on their taxes?

For tax years 2018–2025, federal law suspended the deduction for unreimbursed employee expenses, and it has recently been finalized. Unless the law changes, W‑2 employees generally cannot deduct it. Check the latest IRS rules for the year you file.

Is car allowance taxable?

Allowances under an accountable plan at or below the IRS rate are not taxable. Amounts above the IRS rate are taxable wages. If your employer pays less than the IRS rate, employees usually cannot deduct the difference under current federal rules.