Calculate How Much Reimbursement You can Get with MileageWise:

Fed Up with Pen and Paper?

Are you tired of keeping your Mileage logs on Paper? Did you know that it can take 3-5 hrs/Month to create an IRS-Proof Mileage log doing so? Have you used an App / Excel / Template / Sample but the Outcome was not what you wanted to present as Company Mileage?

THE DEVIL IS IN THE DETAILS

Creating Company-approved Mileage logs ongoing or in a short period of time is a complex task. Especially when you have to do them Retrospectively or under Pressure. Handing in Mileage logs with Gaps and/or Contradictions may result in the Termination of your Employment.

TAKE back CONTROL of your Time

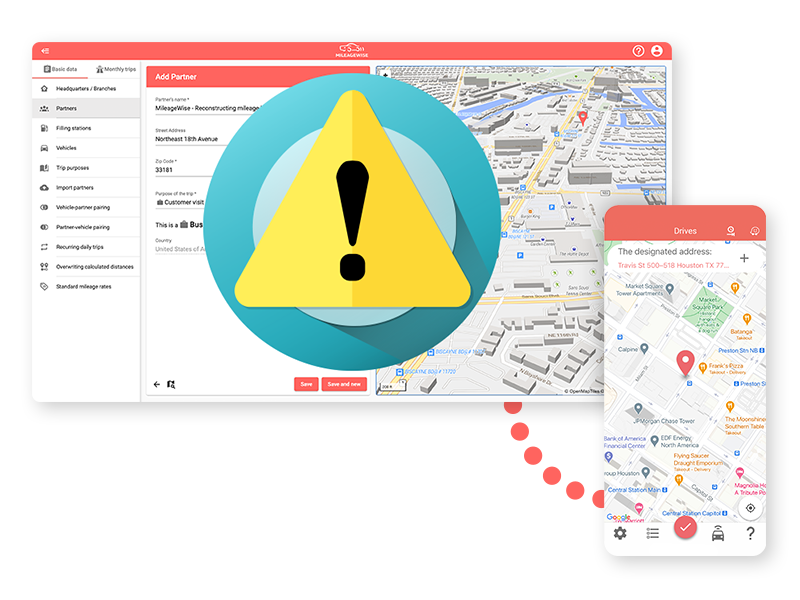

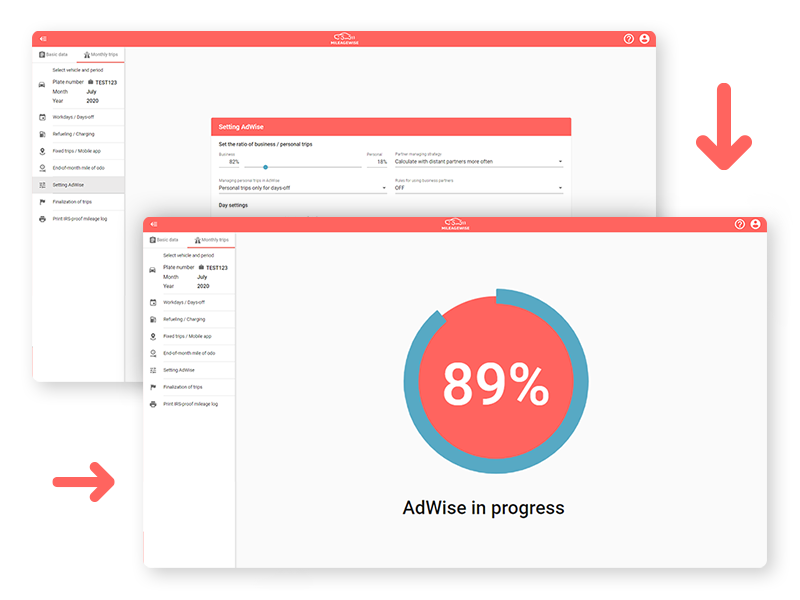

Save Time by using the Mileage Tracker App’s Automatic Tracking Methods and use our AI Wizard technology on Web Dashboard to get a Recommendation for your Missing trips. MileageWise will fill in the Gaps in your Company-approved Mileage logs quickly!

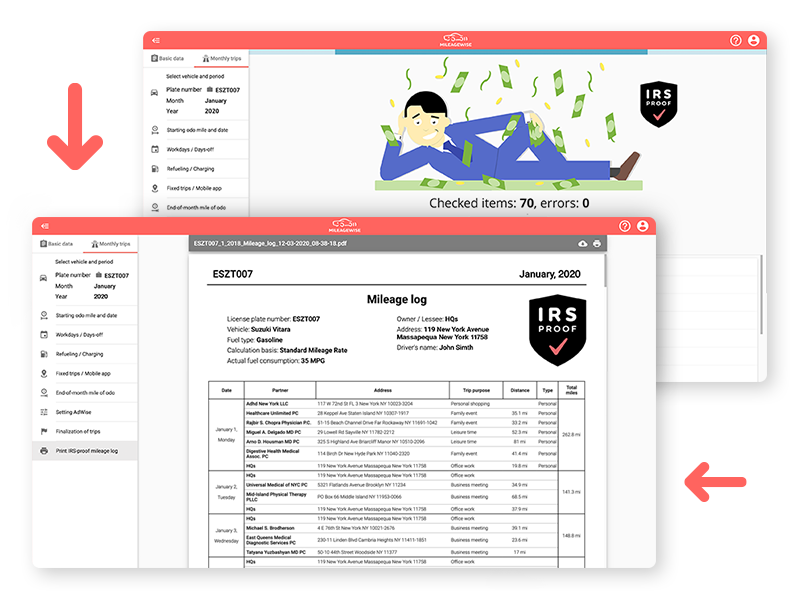

Company-approved logs in 7 mins

The Software checks and corrects 70 Logical Conflicts in your Mileage logs before printing, ensuring that there are no Contradictions found. By creating logs quickly and saving Yourself from the Consequences of Inaccurate Mileage logs, MileageWise becomes the Best Solution on the Market, worth every Penny.